Edward Samp contributed extensively to this article.

Many investors have become interested in the impact of their investment decisions on the world in which we live. While the primary objective of your investment strategy may be financial: e.g., allowing you to live comfortably in retirement or putting your children through college, some investors also desire portfolios that directly express other values. Sustainable investing serves this purpose.

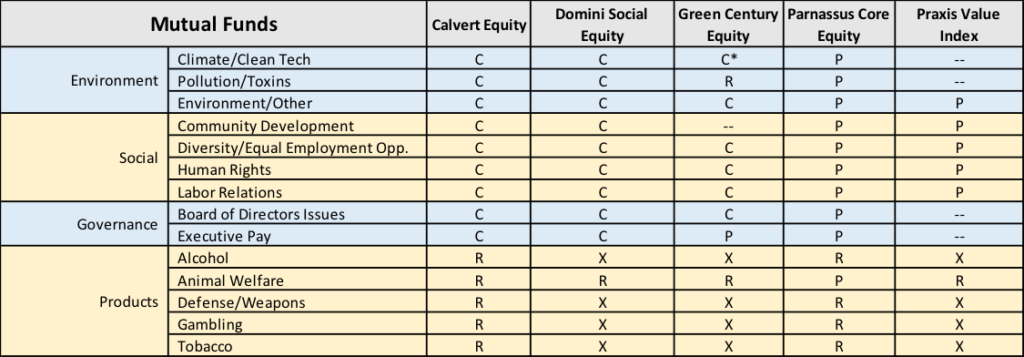

Unlike mutual funds that track standard indexes, which are quite similar to one another, sustainable funds have a wide variety of investment policies. Areas of focus can include minimizing the carbon footprint, social responsibility, restriction of certain industries,[1] human rights, and labor relations. Below are some examples.

Some funds share common elements, but there is no consensus on “sustainability.” Some funds invest in companies with a positive impact in certain areas. Others seek to minimize or entirely exclude companies perceived as having a negative impact. Careful review is required to ensure that you know what you are getting.

Sustainable funds differ from Sensible model holdings in three primary ways (aside from sustainability measures):

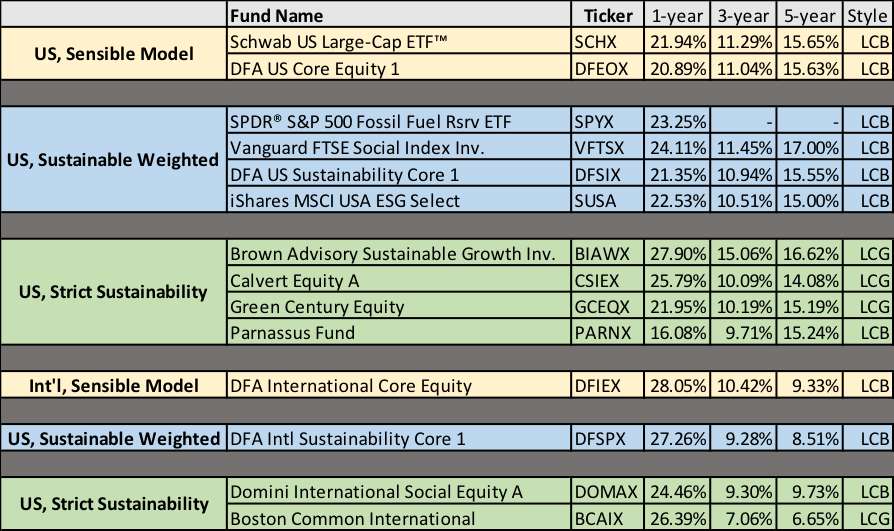

- Most sustainable funds are actively managed, while Sensible model holdings are passively managed. Largely as a result, sustainable funds are more expensive, resulting in lower long-term expected returns.

- Most sustainable funds are small, with less than $1B in assets. With lower liquidity, the cost to move in and out of these funds is higher. If funds remain small and operate at a loss or at low profitability, they may be discontinued.

- Sustainable funds will likely cause greater tracking error and volatility in your portfolio. Underlying companies are typically smaller and more growth[2] In addition, entire industries are often excluded, somewhat reducing diversification.

Based on conversations with some of our clients interested in sustainable funds, we decided to focus on environmental impact in researching funds. Our research relied heavily on two resources:

- US Forum for Sustainable and Responsible Investment (http://charts.ussif.org) identifies and evaluates socially responsible and sustainable mutual funds on numerous factors including climate/clean tech, pollution/toxins, & environmental.

- This source holds itself out as being exhaustive. It is very thorough and is updated quarterly.

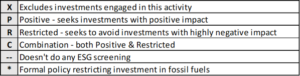

- https://fossilfreefunds.org/ rates numerous funds and ETFs on their exposure to fossil-fuel related companies.

- Carbon Underground 200: 100 coal companies and 100 oil/gas companies with most emissions

- Macroclimate® 50 Coal-Fired Utilities: largest 50 utility companies using coal-fired power plants

- Entire industry sectors: Coal, Oil & Gas, Fossil-Fueled Utilities

In our research, we found that US and international equity have the most robust offerings of sustainable funds. To match these funds as best we can with our Sensible models, we considered only large company stock funds without significant value or growth bias. We segregated our findings into two types of sustainable funds:

- “Sustainable Weighted” funds are more closely aligned with Sensible Financial’s investment philosophy of passive management. This approach has a downside of not scoring quite as well on the fossil-free scale.

- “Strict Sustainability” funds aim to have little or no exposure to fossil-fuel related companies. These actively managed funds are more expensive, meaning lower long-term expected returns.

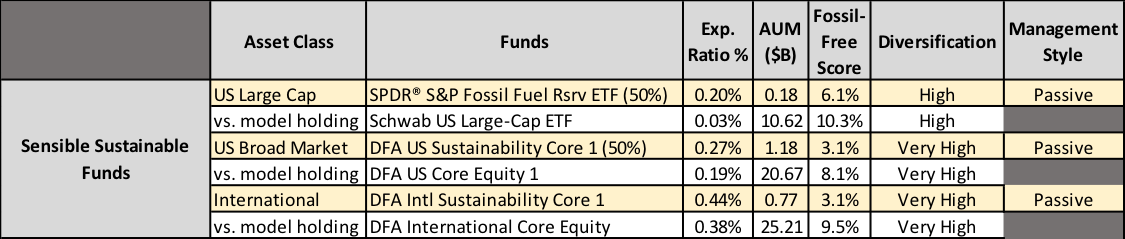

The table below compares sampled sustainable funds to Sensible Financial’s preferred holdings in our standard model. It illustrates the trade-off between cost and environmental impact. For international equity, no funds score perfectly in environmental impact according to fossilfreefunds.org.

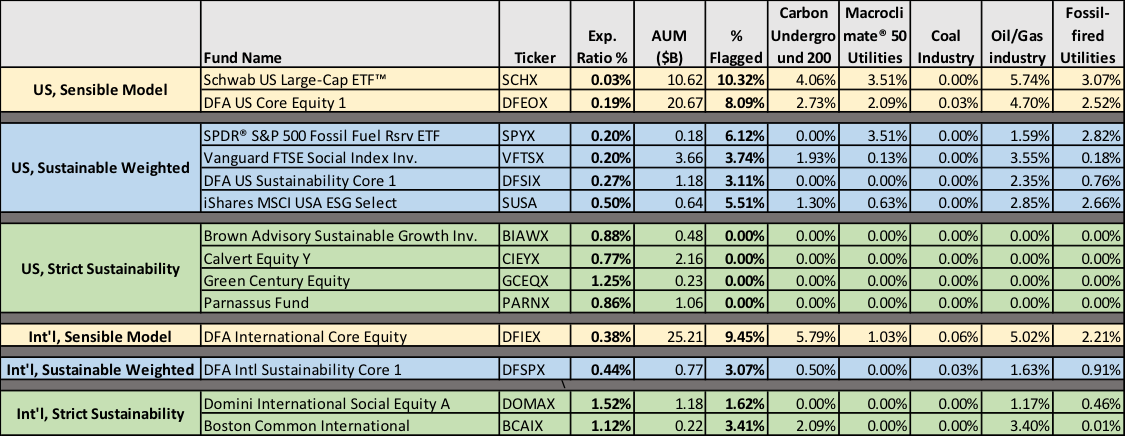

The performance of these funds varies greatly[3]. Each sustainable fund may have a different area of focus dictated by its investment policies, leading to differences in industry exposures and the types of companies in which it invests. The table below illustrates a wide range in returns.

Each of the funds above may follow a different benchmark – often a custom benchmark created by the fund company. Because these benchmarks may (and usually) differ greatly from the benchmarks we use for our Sensible models, this can lead to greater tracking error in your portfolios. In some years, you might enjoy better returns; in other years, returns might be worse. Greater variability in performance reduces confidence in your financial well-being.

Research from numerous studies points to overwhelming empirical evidence that funds with lower expense ratios (passively invested funds) generate greater long-term returns. As a firm, we do not recommend actively managed portfolios. Because of this, we have decided to recommend the Sustainability Weighted approach – it is better aligned with our investment philosophy. The table below summarizes our sustainable recommendations.

We are pleased to offer this sustainable investing approach to our clients. It is important to be clear that that sustainable investing is somewhat more expensive. If you are interested in exploring sustainable investments further, please contact your advisor.

[1] Alcohol, gambling, tobacco, and weapons industries are often excluded.

[2] Sensible Financial portfolios usually “tilt” towards value stocks and away from growth stocks in anticipation of slightly higher and less volatile returns.

[3] Trailing returns as of 12/31/17

Rick Miller is the founder of Sensible Financial Planning and Management. To ask Rick or another member of our team about planning for your financial future, please get in touch!