Your car is one of the most expensive items you own. Costs include the purchase of the car itself, finance costs, fuel, insurance, state fees, maintenance and repairs. According to the Bureau of Labor Statistics, vehicle-related expenses were the second highest after-tax expenditure (15%) for the average US household in 2017, between housing (33%) and food (13%). This makes the question of affordability, from the perspective of your lifetime financial plan, the most important element when it comes to choosing a car. For example, can you adequately maintain your living standard and other financial obligations if you buy the luxury rather than the economy model? The more you spend on vehicles over your lifetime, the fewer resources you’ll have for other needs and wants. Deciding whether to buy or lease is therefore a secondary, albeit important, question.[1]

In what follows, I tackle the financial question of buying versus leasing. When is buying a better deal, and by how much? How does the car’s resale value impact the associated payments? How does the number of years you keep your car, its resale value, and maintenance costs impact the trade-offs?

Your car is rapidly depreciating

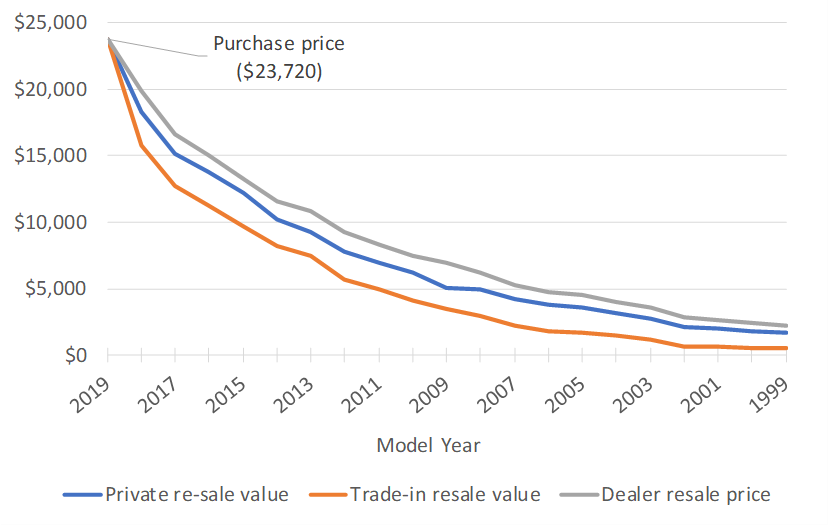

Your car has a lot more in common with your toaster than your home. For starters, it’s a depreciating asset, requiring ongoing maintenance and repairs, with an average lifetime of about 16 years. Not only is it costly to maintain (the average US household spent $954 on car maintenance and repairs in 2017), but its fair market value declines rapidly. A base-model 2019 Honda Accord sells for $23,720. According to Kelley Blue Book, a 2018 model in good condition sells for 23-34% less depending on whether it’s sold privately (see blue in Figure 1) or traded-in to a dealer (see orange). After just four years, the vehicle has lost over half its market value. Even the dealer, who gets a premium resale price (see gray), can get only half the original price after five years.

Your car’s resale value matters

When you buy a car, you pay the sales price upfront or finance the purchase over a certain number of months. You’re in charge of maintaining and repairing the vehicle, meaning you can expect increasing expenditures of time and money as the car ages. Importantly, when you buy, you acquire the car’s resale value. You can sell the car whenever you’d like, to whomever you’d like, and pocket the cash.

When you lease a car, you pay a monthly fee, and possibly a down payment, to the dealer for the duration of the lease. Unless you purchase a maintenance package from the dealer, you’re in charge of maintenance and repair costs as needed.[2] Most manufacturers offer a warranty that lasts at least three years, meaning the vehicle’s main components are covered for malfunction for the duration of the lease. Importantly, when you lease, the dealer retains the car’s resale value. At the end of the lease, the dealer can sell the vehicle and pocket the cash (see gray in Figure 1).

So, when you buy a car you’re not only buying the transportation services the vehicle provides, you’re also buying an option to resell the vehicle. This option has economic value, meaning it comes at a price. Essentially, the car’s resale value is incorporated into the purchase (or lease) price. If you buy, you pay a premium because you own the right to resell the vehicle. If you lease, you won’t pay the premium because the dealer owns the right to resell the vehicle. This means the higher the car’s resale value the higher the purchase price and lower the lease payment.[3]

Buy and maintain vs lease and re-lease

An ideal way to compare the relative benefits of one purchase (or investment) to another is to compare the net present value (NPV) of the stream of cashflows. The NPV tells you how much you’d be willing to pay today for that specific series of future cashflows. The series of cashflows with the largest (or least negative) NPV is the best option financially, with the difference in NPVs providing a measure of how much better off you will be.

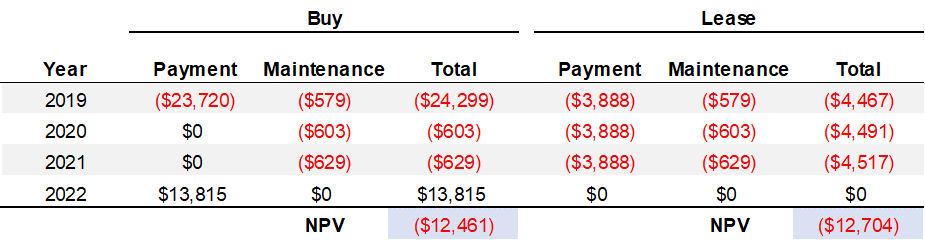

Table 1 illustrates the cashflows for buying and leasing a base-model 2019 Honda Accord over a three-year lease term. If you buy, you pay $23,720 upfront and the car is worth $13,815 at the end of three years (see blue in Figure 1). If you sign a three-year lease, and put $0 down, you pay $388 a month and the dealer retains the resale value. Because both cars are brand new, the maintenance and repair costs are the same over the term of the lease.[4]

The NPVs over the three-year lease period are very similar—the difference being only $243 in favor of buying.[5] This means that if you plan to keep your car for exactly the three-year lease period you’re only slightly better off buying—most likely, it’s a wash. This makes sense because the dealer sets the lease payments such that they are indifferent between leasing or selling the car in the first place.

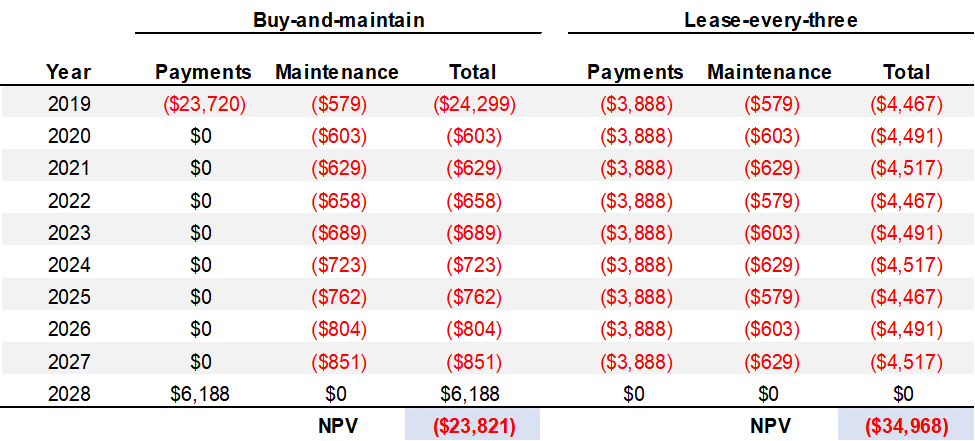

Now, suppose you buy and maintain your car for longer than the three-year lease period. First, maintenance and repair costs will go up and the resale value will go down as the (“buy-and-maintain”) car ages. Second, for an apples-to-apples comparison, you need to assume the alternative to maintaining the vehicle is leasing a new one every three years (“lease-every-three”). Table 2 illustrates the cashflows over the nine-year period.

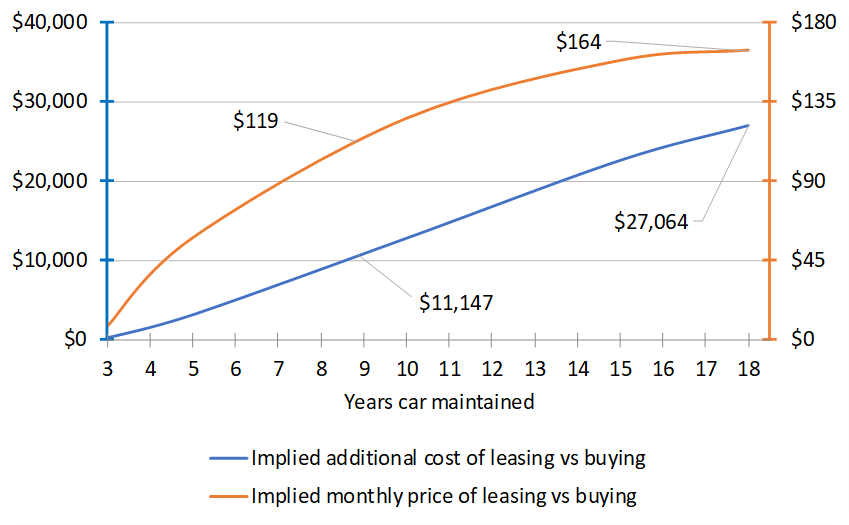

The difference in NPVs is now $11,147 in favor of buying. This means that if you plan to keep the car for nine years you’ll be that much better off than if you had leased the newest model every three years.[6] If you convert the value into a monthly figure you get $119.[7] Financially speaking, you are surely better off buying. However, driving a new car every three years is different than driving and maintaining an aging car. In fact, a better way to interpret the difference in NPVs is to consider the $11,147 as the implied additional cost for driving the newest model every three years as opposed to buying and maintaining the aging vehicle over the nine-year period. The $119 can then be interpreted as the implied monthly price, or monthly premium, you will pay over the nine-year period. This then begs the question, is it worth the price?

How much are you willing to pay to drive the newest model?

As Tables 1 and 2 illustrate, the longer you plan to maintain your vehicle the costlier is the alternative option of leasing the newest model every three years. The same goes for if maintenance and repair costs are lower and/or the resale value is higher than expected. Figure 2 shows the implied additional cost for driving the newest model every three years (see blue) and the implied monthly price (see orange), as a function of how long you plan to maintain the vehicle. For example, if you lease new models every three years as opposed to buying and maintaining the vehicle for nine years, you will have spent $11,147 over that period, or $119 a month, solely for the privilege of driving the newest model. Maintaining the vehicle for eighteen years means you will have spent $27,064, or $164 a month, for the privilege. The longer you plan to maintain the vehicle, the more expensive the leasing alternative becomes, and vice-versa.

Is $119 to $164 a month, or roughly a third to a half of the monthly lease payment, too much to pay for the privilege of driving a new model every three years? Well, it depends on your willingness to pay. People who love having the newest style or technology, place a particularly high value on their time, or simply despise maintaining and repairing their cars will find leasing to be relatively more attractive. If you find yourself trading in your vehicle every 3-5 years, then you are likely to be just as well off if you lease instead.

Conclusion

Cars are expensive, and they don’t last forever. For that reason, the question of how much car you can afford is critical to your financial plan. Don’t be fooled by those who tell you that you can lease a more expensive car than you can buy simply because you can “afford” the monthly payments. This is nothing more than a sales tactic used by dealers and manufacturers to get you to pay more.

Whether you decide to buy or lease is also important. Leasing and re-leasing, as opposed to buying and maintaining, can cost you an additional $100+ a month for a Honda Accord or equivalent. Over a lifetime of buying or leasing cars, this can add up!

This doesn’t mean that leasing is never worth it. A good rule of thumb is to consider about a third to a half of the monthly lease payment (assuming $0 down) being the monthly premium you will pay to drive the newest model versus buying and maintaining the same vehicle for a period of nine to eighteen years. Assuming the car and leasing option are affordable from the perspective of your financial plan, you can then decide whether you are willing to pay the additional cost for the privilege of driving the newest model.

Another option may be to take your savings (the $100+ a

month from not leasing) and spend it on an exotic, classic or luxury car

rental. How about a yellow

Lamborghini for the day for $1,000? There’s good

evidence this may generate greater happiness than leasing a new car every

few years. Either way, enjoy the ride!

[1] Deciding whether to finance the expense is a tertiary question, and one not addressed in this article.

[2] There are guidelines for how a leased car is to be serviced and repaired. Typically, you are required to bring it to a licensed dealer. Taking your car to a non-approved garage, for example, may invalidate the warranty.

[3] Generally speaking, the dealer calculates the lease payment such that the net present value of lease payments and the vehicles expected future resale value is equal to the sales price they can get for selling it new.

[4] Car maintenance and repair costs are difficult to estimate. I assume a depreciable cost of 61% of the car’s sales price (based on industry estimates of the cost for parts and labor) and a depreciation rate based on the life expectancy of the vehicle as it ages. I then calibrate the estimates based on the average age of vehicles in the US, a vehicle’s average lifetime, and annual maintenance and repair estimates of $954 for the average US household.

[5] I assume a 3% annual discount rate, which is the current yield on 30-year US Treasury Bonds.

[6] For simplicity I’ve excluded insurance and state fees and assumed that lease payments for subsequent model years remain unchanged. To the extent that insurance premiums and state registration fees decrease with the car’s age and/or newer models have higher lease payments, the NPV comparison will only further tip in favor of buying vs leasing.

[7] This is calculated as the fixed monthly payment over the nine-year period that would yield a present value exactly equal to the difference in NPVs between buying and leasing ($11,147).