How much you spend on vehicles over your lifetime can be significant. The more you spend, the fewer financial resources you’ll have in your lifetime budget to spend on other needs and wants. In my previous article, I looked at the financial impacts of buying new versus leasing. In summary, leasing and re-leasing a new car, as compared to buying and maintaining a new car, is equivalent to paying a monthly premium for driving the newest model every few years. In this article, I explore the alternative of buying and maintaining a used car. I will show that buying used, as compared to buying new, is financially equivalent to being paid a monthly stipend for not driving a newer model.

In what follows, I analyze the financial decision of buying new versus used. When is buying used a better deal and by how much? If you buy used, how old should the vehicle be when you buy it? How does the number of years you keep your car, its resale value, and maintenance costs impact the trade-offs?

The tradeoffs of buying used

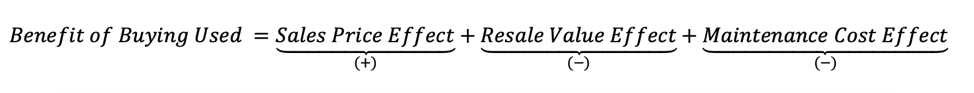

There are three main financial effects (pros and cons) of buying and maintaining a used rather than new vehicle.[1] I call these the Sales Price Effect, the Resale Value Effect and the Maintenance Cost Effect.

The Sales Price Effect (pro): A car’s fair market value declines rapidly (see Figure 1 from my previous article).[2] This means buying used can save you a lot on the purchase price. According to Kelley Blue Book, a base-model Honda Accord in good condition with average miles sells for less than half its market value after just four years. Taking advantage of this rapid price depreciation is by far the biggest financial benefit of buying used.

The Resale Value Effect (con): On the other hand, this price depreciation also implies that the resale value of an older vehicle will otherwise be lower than an equivalent newer model. If you decide to resell (or even donate) the vehicle, this means you’ll get less back than if you had purchased the newer model.

The Maintenance Cost Effect (con): The other main drawback of buying used is that older vehicles should have higher maintenance costs. Just like your home, a car has many components each with different replacement costs and life expectancies. As a car ages, each component gets closer and closer to its expiration date. This means you can expect to have higher maintenance and repair costs for an older vehicle, all else equal.

Buying used can save you a lot, but is it worth it?

As in my previous article, an ideal way to compare the benefits of one purchase to another is to compare the net present value (NPV) of the cashflows. The NPV tells you how much you’d be willing to pay today for that specific series of future cashflows. Therefore, the series of cashflows with the largest (or least negative) NPV is the best option financially, with the difference in NPVs providing a measure of the relative benefit.

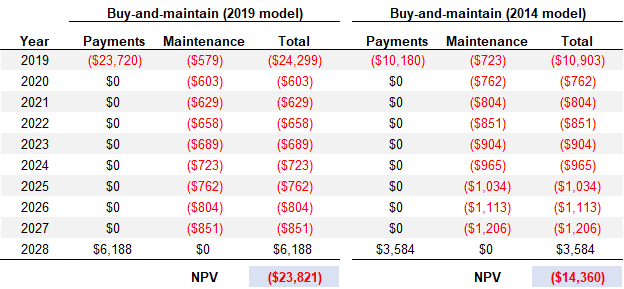

Table 1 illustrates the cashflows for buying a new (2019) versus a used (2014) base-model Honda Accord, assuming a fixed nine-year maintenance period.[3] Buying new and maintaining for nine years means you’ll pay $23,720 at purchase, receive $6,188 at resale and pay $6,297 in maintenance expenses. Buying a used 2014 model means you’ll pay $10,180 at purchase, receive $3,584 at resale and pay $8,361 in maintenance expenses.[4]

Table 1. Nine-year cashflow comparison of buying and maintaining a 2019 versus a 2014 Honda Accord

The difference in NPVs is $9,461 ($23,821 – $14,360) in favor of buying used. This is what I call the Benefit of Buying Used. In this case, the benefit amounts to a 40% savings compared to buying and maintaining the new 2019 model. If you maintain the car for nine years, you’ll be that much better off (in today’s dollars) having purchased the used 2014 model.[5] This $9,461 benefit is equal to the present discounted sum of the three main effects outlined above:

If you convert the value into a monthly figure you get $101.[6] In this example, you are surely better off buying used.[7] However, driving and maintaining an older model is certainly different from buying and maintaining the newer model—e.g., design, technology, safety features, wear and tear. An alternative way of interpreting the difference in NPVs is to consider the $9,461 as the implied total receipt (in today’s dollars) for driving the older (2014) model as opposed to the newer (2019) model over the nine-year period. The $101 can then be interpreted as the Implied Monthly Stipend you will receive over the nine-year period. This then begs the question, is it worth it?

Ultimately, the decision will depend on your willingness to accept. In other words, is receiving an initial lump sum payment of $9,461 or a monthly stipend of $101 for 9 years enough to incentivize you to choose the five-year-old model over the new model? People who don’t mind driving the older style or technology, maintaining and repairing an older vehicle, or not having the newest safety features will have a lower willingness to accept. This means they will find buying used to be relatively more attractive.

If you decide to buy used, how old should the car be?

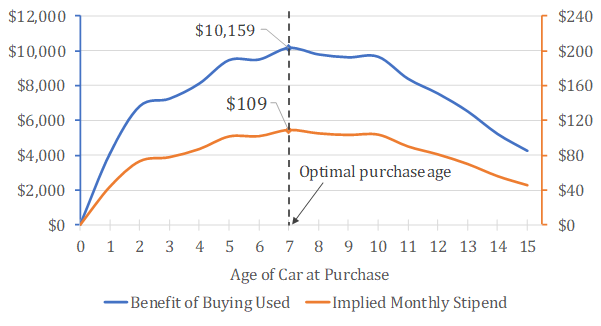

If you decide to buy a used vehicle, you’ll need to choose which model and how old. Besides affordability, the question of which model to buy will mostly focus on personal preference.[8] The question of how old can be addressed using the NPV framework above. Intuitively, if the objective is to maximize savings, the optimal age at which to buy a used vehicle is that which maximizes the Benefit of Buying Used (see equation above). This will also maximize the Implied Monthly Stipend. (Note that you’ll still have to personally decide whether it’s worth it for the amount you can save!)

By rerunning the analysis in Table 1 for used Honda Accords of different ages you can determine the age at which the Benefit of Buying Used is the largest. Figure 1 below illustrates this analysis. The Benefit of Buying Used (blue) and the Implied Monthly Stipend (orange), for a Honda Accord and a fixed maintenance period of nine years, are largest when you buy a seven-year-old model ($10,159 and $109, respectively). If you were to buy a younger or older model, the Benefit of Buying Used would be smaller.[9]

Figure 1. The Benefit of Buying Used and Implied Monthly Stipend are largest when buying a seven-year-old Honda Accord, assuming a nine-year maintenance period.

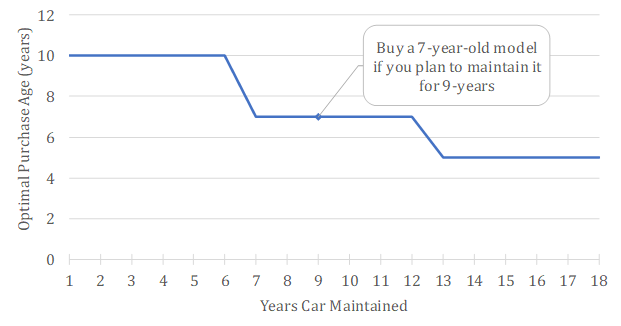

Now, as you can imagine, the amount of time that you maintain the vehicle may impact the optimal age at which to buy a used car. In general, the Benefit of Buying Used will decline as you maintain the car for longer.[10] This is because maintenance and repair costs can increase significantly as the car ages. Running the analysis again for different maintenance periods illustrates that the optimal age at which to buy a used Honda Accord is between five and ten years (see Figure 2). The longer you plan to maintain the car (x-axis), the younger the car should be when you purchase it (y-axis). Again, this is driven primarily by rising maintenance and repairs costs as the car ages. You don’t want to be stuck maintaining a significantly older vehicle, even if you received a sizeable discount on the sales price!

Figure 2. The optimal age at which to purchase a used car will decline if you maintain the car for longer. For a Honda Accord the optimal age is between five and ten years.

Conclusion

Cars are expensive. However, because their fair market value declines rapidly, one way to save on the expense is to buy a used vehicle. For a Honda Accord, buying and maintaining a used, rather than new, model can save you more than $100 a month. Over a typical maintenance period of 9 years, this can amount to a savings of over $10,000 or 40% compared to buying new. Over a lifetime, this can add up!

Buying used, as with leasing, is not for everyone. Ultimately, the decision comes down to how much you’re willing to accept to drive and maintain an older model vehicle. If a 40% discount looks attractive, for a Honda Accord or equivalent, then consider buying used.

If you do decide to buy used, pay attention to the car’s age and mileage, and have a trusted mechanic inspect its overall condition. To maximize your savings, you should buy a younger car with fewer miles if you plan to maintain it for many years. Otherwise, if you plan to maintain it for fewer years, buying an older car with more miles can increase your savings. For a Honda Accord, my analysis suggests that buying a five- to ten-year-old model will maximize savings.

If you’ve never thought about buying a used car before, consider what you can do with the savings. Maybe you’re willing to drive the 5-year-old model if it means taking a weeklong Alaska cruise or skydiving in Hawaii with family and friends? Life is all about trade-offs. Either way, enjoy the ride!

[1] There are other possible effects including differences in insurance premiums, taxes and fees, and fuel expenses. However, these effects are likely to be relatively minor and therefore omitted from my analysis.

[2] The rapid decline of a cars fair market value is at least partially due to the depreciation of its components. The more accumulated depreciation, the lower the resale (or actual cash) value. For example, a car with a broken timing belt will cost less than an equivalent vehicle with a new timing belt. The difference in resale value will be at least the cost of a new timing belt (about $700 for a Honda Accord). However, the market for used vehicles can be plagued by what economists call asymmetric information, which can reduce resale values below what one may expect based on the vehicles accumulated depreciation alone. See George Akerlof’s famous article on The Market for Lemons.

[3] A fixed maintenance period for both new and used vehicles is a simplifying assumption. To the extent that the older model has a higher risk of becoming inoperable, the Benefit of Buying Used will be slightly overstated. That said, cars today last a very long time. More than 50% of cars on the road today are over 11 years old.

[4] See endnote 4 in my previous article for details of how I estimated maintenance costs.

[5] I assume a 3% annual discount rate, which is about the current yield on 30-year US Treasury Bonds. Interestingly, the greater the discount rate the greater the Benefit of Buying Used. This means in an environment of rising interest rates, buying used becomes more attractive, and vice-versa.

[6] This is calculated as the fixed monthly payment over the nine-year period that would yield a present value exactly equal to the difference in NPVs between buying used and buying new ($9,461).

[7] You will always be financially better off buying used unless the Resale Value Effect and/or Maintenance Cost Effect more than outweigh the Sales Price Effect. This is most likely to occur if the used car turns out to be a “lemon,” requiring significant unexpected repairs.

[8] For the most part, a vehicle’s projected resale value and maintenance expenses (along with its attributes) will be fully captured in the vehicle’s sales price. However, if a car’s styling, for example, temporarily inflates its price above what would be expected based on the car’s resale value, maintenance expenses and attributes then the purchase of this “overpriced” vehicle would be less attractive from a purely financial perspective.

[9] Buying a used car that is too young means the benefits of lower maintenance expenses and a higher resale value are outweighed by the costs of a higher purchase price. Buying a used car that is too old means the costs of having higher maintenance expenses and a lower resale value outweigh the benefits of the lower purchase price.

[10] This is not always the case and will depend on the specific magnitudes of the Resale Value Effect and Maintenance Cost Effect.