Clients, especially new clients, sometimes ask us how their spending compares to other people’s. There is the sense that if they are doing what other people are doing, then they are probably “okay”. Our response has usually been that there is a very wide range of spending levels, and an “okay” level of spending depends on many factors that are particular to each household.

That said, we decided to look at spending levels across a sample of our client base, just to see what we would learn. We selected a random sample of 50 clients for whom we did a comprehensive financial plan for the first time in 2021-24. The sample is not necessarily representative of anything other than new financial planning clients of Sensible Financial.

Our analysis

Now, here is a little bit about how we did our analysis. Sensible Financial clients know that when we create a financial plan, we break down spending into a handful of categories.

- Housing (rent, mortgage, homeowners’ insurance, utilities, maintenance)

- Taxes (income taxes, capital gains taxes, and payroll taxes)

- Insurance (health insurance, life insurance, disability insurance, long-term care insurance)

- “Special Expenses” (irregular or limited duration spending, such as new cars, college tuition, or weddings)

- Consumption (day-to-day living expenses)

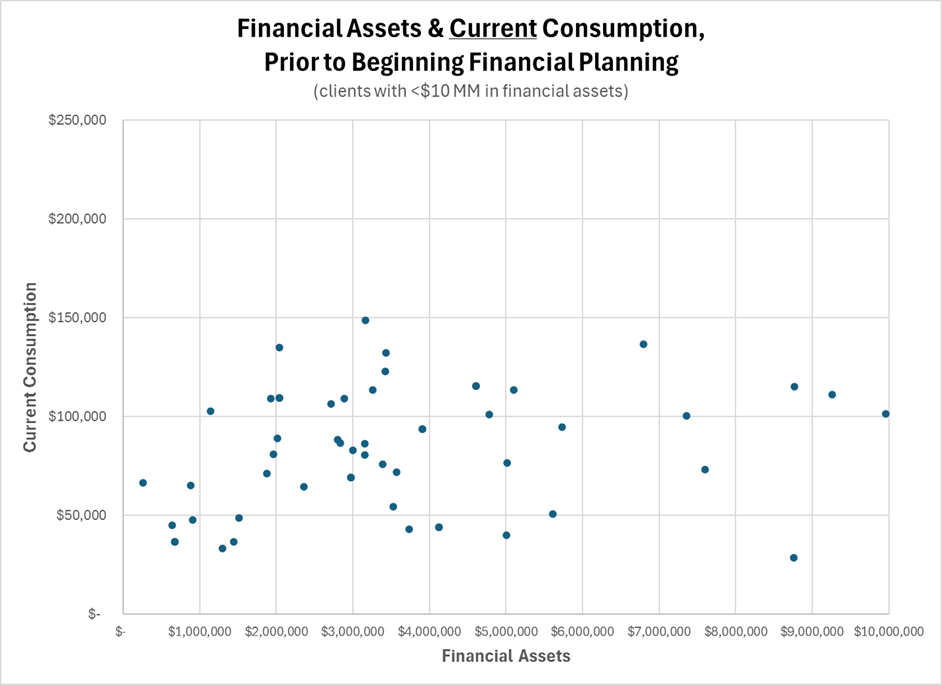

It is this last category that we focused on for this analysis. Though all spending matters, consumption is a category that impacts people every day and can be thought of as their living standard. We also chose only financial plans for clients with whom we were working for the first time, and we used their self-reported consumption spending figures (using a definition and methodology we supplied), from before we started our financial planning process (i.e., before their spending was influenced by our work).

What we found is that in this data set there is a wide range of annual household consumption spending amounts, from $28,000 to $148,000. So “what your other clients are spending” turns out to be not very helpful in gauging okay spending.

We decided to take it further, reasoning that perhaps people with similar levels of financial assets would spend at similar rates. In other words, if I find people with similar levels of financial assets, then their spending will be a good guide for me. However, even that doesn’t seem to help. In the table that follows, the eye doesn’t see much of a relationship between financial assets and consumption spending, and the statistical analysis doesn’t either: the R-squared is only 5%. R-squared is a statistical measure of how closely related two variables are. It ranges from 0% (no statistical relationship) to 100% (perfectly correlated).

So, if looking at what other people spend isn’t a good guide for what is okay, even when looking at people with similar levels of financial assets, perhaps those assets will at least provide guidance about what a financial professional would say about affordable spending. After all, the popular press abounds with articles about “what is your retirement number?”.

What is affordable spending?

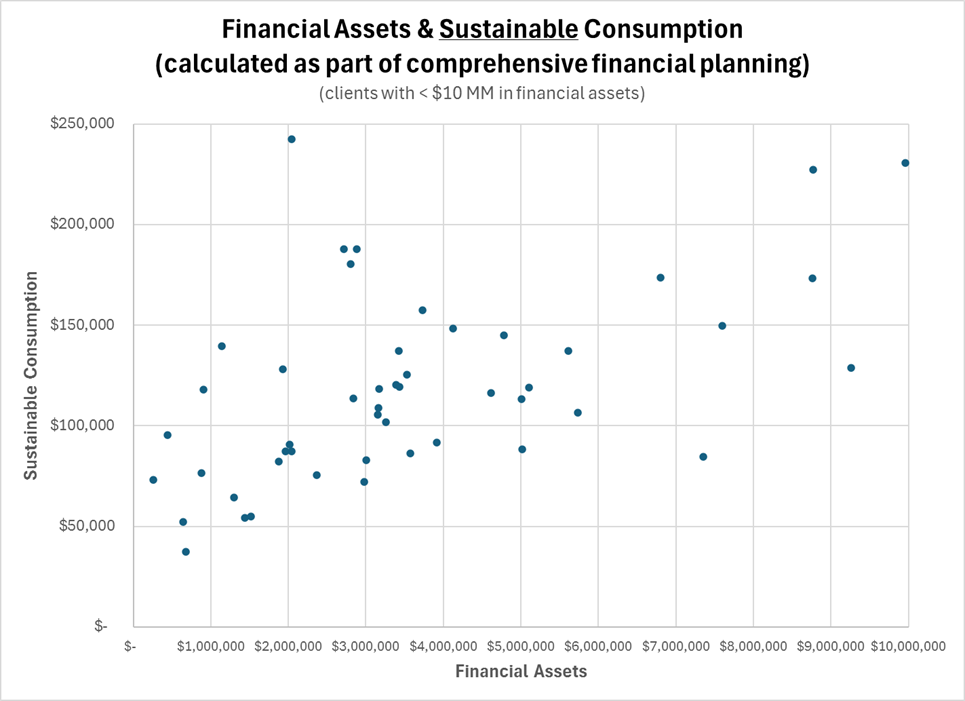

As financial planning professionals, we help people understand what an affordable spending level is. That is a key deliverable when clients hire us to advise them. The methodology we use calculates a “sustainable living standard”, which is the annual consumption spending figure that would exhaust one’s financial assets at (but not before) the end of their lives (we usually plan to age 100). That is our professional view of what is affordable. One might think that this sustainable living standard might bear a closer relation to financial assets than clients’ spending prior to working with us does. After all, that sustainable living standard figure is based on serious financial analysis. However, we found that the sustainable living standard, though upward sloping with assets, still had a very wide range of outcomes, as shown in the next graph. Those with about $3 million in financial assets could afford anywhere from about $72,000 in annual consumption spending to about $187,000, for instance. In this case, the R-squared was 34% — much better, but still not a close enough relationship to be very useful.

Recognizing that some of the households in the data set included one adult and some had two; also, that some households had children living at home, we tried various corrections, but they did not improve the results.

So, rather than finding a useful relationship between assets and affordable spending, we see that it must be necessary to incorporate the other financial characteristics of these households to say how much spending is affordable. Those other characteristics include:

- How much do you or will you spend on other items, such as housing, insurance, or large “special expenses” like college tuitions?

- Do you have a mortgage or other debt?

- Are your assets pre-tax (like in a 401k) or after-tax?

- Do you have large unrealized capital gains in your portfolio?

- For how many more years will you work, and for how much pay?

- How large is your Social Security benefit?

- Do you have a pension?

- Do you have retiree healthcare benefits?

- Do you expect to receive gifts or an inheritance?

- Do you expect to financially support a child or a parent?

People spend and consume differently

These factors really do matter and need to be incorporated into one’s thinking about the amount of spending that is okay, to not outlive your assets. This consumption spending analysis also brings to light that people have different preferences for how they spend their money. Some people like larger houses or more expensive neighborhoods, others like to travel a lot or send their children to private schools, while others like to have a large financial cushion as a protection against unexpected circumstances. All these choices influence what people spend on consumption.

This is why looking to see what others are doing is an unreliable way of determining whether one is spending too much on consumption. It’s also why simple approaches often seen in the popular press, purporting to provide the answer to how much you need to retire, are inadequate indicators of affordable household spending. Comprehensive financial planning is required to be confident that you know what you can afford.

Photo by Vitaly Mazur on Unsplash