This article originally appeared in Forbes.com.

Social Security retirement benefits are most Americans’ retirement income foundation. Given their importance, you might think that everyone would know exactly how their retirement benefit is calculated. If I were a betting person (which I’m not), I’d be willing to wager that almost no one does.

The SSA (Social Security Administration) calculates your retirement benefit based on your earnings history and the date you start benefits. The calculation method is conceptually simple, but the mechanics are very complex.

Here’s how it works:

- Calculate your Average Indexed Monthly Earnings (AIME). Higher AIME means a larger benefit.

- Translate your AIME into your Primary Insurance Amount (PIA). A larger PIA means a larger benefit.

- Adjust your Social Security retirement benefit based on when you start receiving benefits relative to your Full Retirement Age (FRA). Starting later (up to your age 70) means a larger benefit.

Your AIME

The first step translates your earnings history into your AIME:

- Only your Social Security Earnings (the earnings on which you paid Social Security or FICA taxes) count.

- SSA indexes your Social Security Earnings, attempting to approximate what your earnings would have been if they had all been paid in the year you turned 60 by adjusting for inflation and productivity growth.

- SSA averages your indexed earnings for the 35 highest years.

- Then SSA calculates the monthly amount for that average.

Each of the words in Average Indexed Monthly Earnings is relevant and helps us understand what influences your benefit.

Earnings

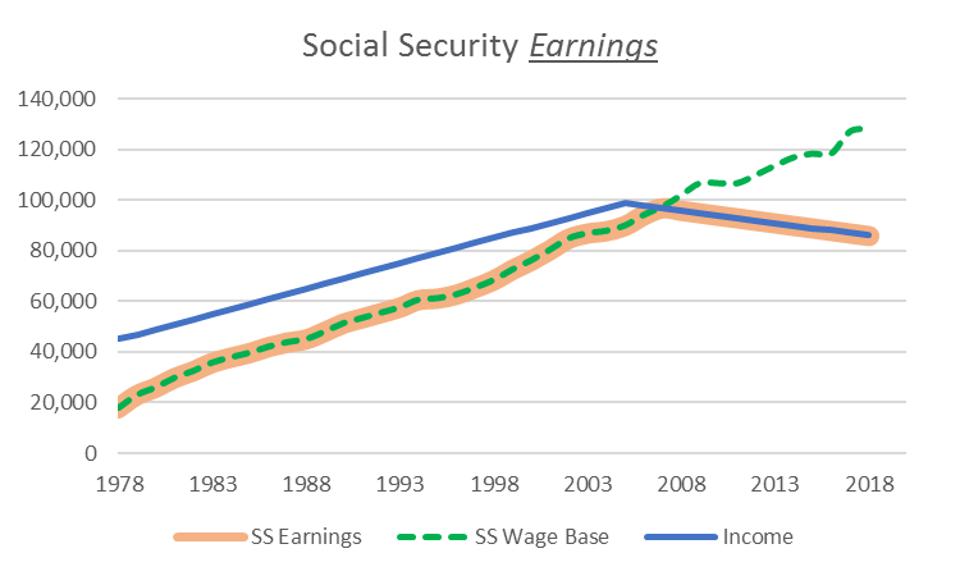

Every year, the (SSA) defines the Social Security Wage Base. If your income is below the Wage Base, you pay Social Security (FICA) tax and get benefits based on your actual income. If your income is above the Wage Base, you pay FICA tax and get benefits on only the amount up to the Wage Base.

Therefore, in any year, your Social Security Earnings (used in calculating AIME) are your wage or salary income, including any retirement contributions made by you or your employer, up to the Wage Base. Investment income, business income, rental income or any other kind of income are not included.

The chart shows the calculation of Social Security earnings for someone (call her Jane) who started working in 1978 at 25. Jane earned $45,000 in 1978, increasing $2,000 per year until 2007, then decreasing $1,000 per year until retiring in 2018 at 65. Jane’s Social Security earnings (wide orange line) equal the Wage Base (green dashed line) until 2006, because her income exceeds the Wage Base. In 2006 and after, Jane’s Social Security earnings equals her income (solid blue line), as her income is smaller than the Wage Base.

Indexed

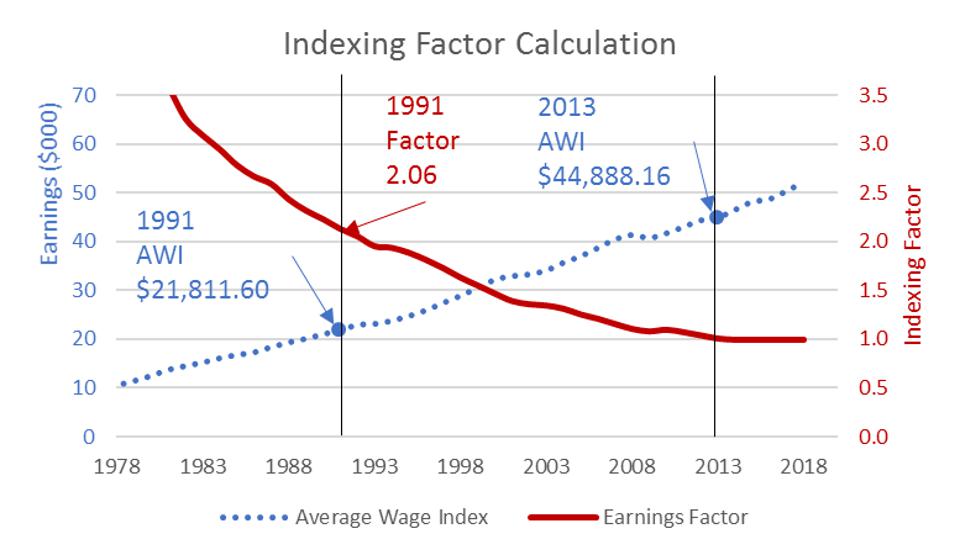

Indexed earnings adjust Jane’s Social Security earnings for every year up to and including the year she turns 60, attempting to approximate what they would have been if Jane had earned them in the year she turned 60. Every year, the SSA calculates the average earnings of all US workers (the Average Wage Index or AWI, dotted blue line in the graph below).

What is indexing?

Wages tend to rise from year to year because of inflation and productivity increases. “Indexing” your previous earnings to the year you turn 60 attempts to put every year’s earnings on the level of that year.

For example, suppose you worked only two years, ages 59 and 60. And you earned exactly what the average worker earned in each year — $50,000 at 59 and $100,000 at 60. If we just average your earnings for the two years, we get $75,000, which is 75% of the average worker’s earnings at your age 60. But you earned the same as the average worker each year — not fair!

Instead, we index your age 59 earnings to the average worker’s earnings at your age 60. Since you had exactly what the average worker earned at your age 59, we “index” those earnings to the average at your age 60, $100,000. We multiply age 59 earnings by 2 to get $100,000. That makes 2 the indexing factor for age 59. Then, we take the average of earnings for ages 59 and 60 and get $100,000 — the average at your age 60.

Calculating the index factor

For each year up to and including the year you turn 60 (the prior year if you were born on New Year’s Day):

- Calculate the indexing factor (the ratio of the AWI for the year of your 60th birthday to the AWI in that year, solid red line in the graph).

- For example, Jane turned 60 in 2013. To calculate Jane’s indexing factor for 1991, we divide the AWI for 2013 ($44,888.16) by the AWI for 1991 ($21,811.60), obtaining 2.06.

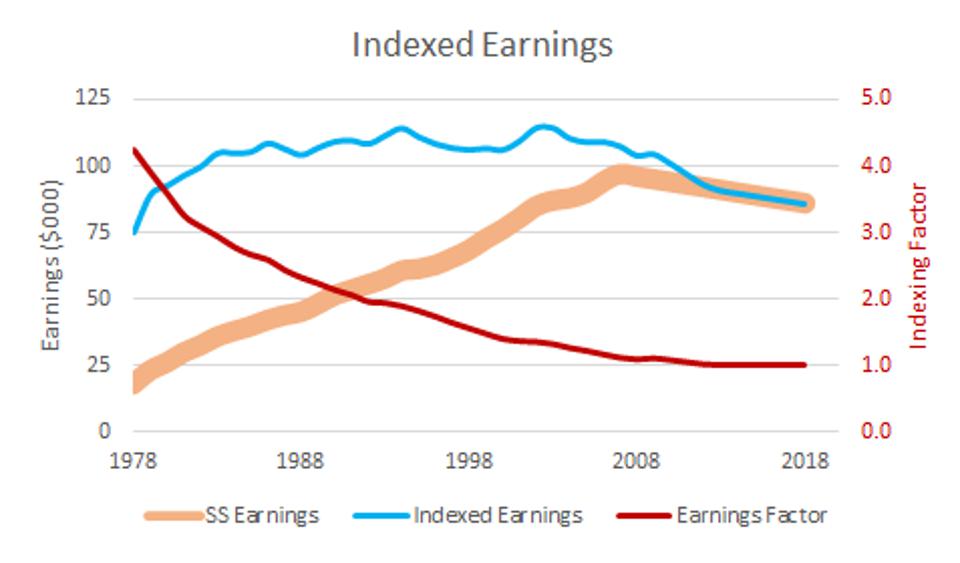

- Multiply your Social Security earnings by the indexing factor (see chart below). Jane’s 1991 indexed earnings are her 1991 Social Security earnings times 2.06.

- Jane’s indexing factors are over 4 for 1978, over 3 from 1979-1982, and over 2 after that until 1991.

- Earnings for years after you turn 60 are not indexed. In effect, Jane’s factors after 2013 are all one (1.0).

- Jane’s indexed earnings (light blue) are higher than her Social Security earnings (wide orange) all the way up to 2012. As we’ll see later, this has a major positive impact on her benefit.

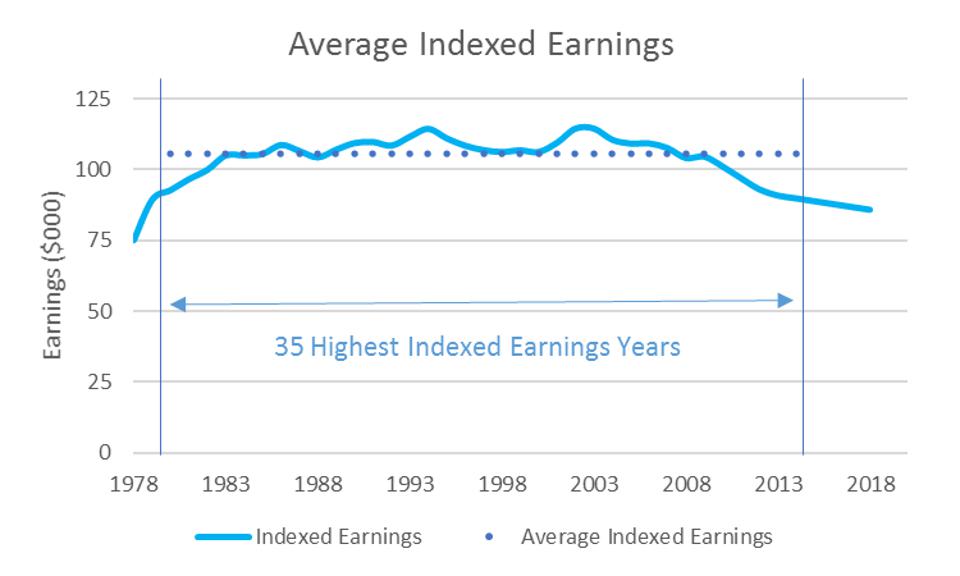

Average Indexed Earnings

Average indexed earnings are the average of your highest 35 years’ indexed earnings. If you have fewer than 35 years of Social Security earnings, the average includes only years with positive earnings.

The chart shows Social Security earnings and Indexed Earnings for Jane. The two vertical lines bracket her 35 highest Indexed Earnings years (1980 to 2014). Average Indexed Earnings are approximately $105,500.

Average Indexed Monthly Earnings

AIME divides average indexed earnings by 12 (the number of months in a year). This is easy to calculate (no chart required!). In our example, Jane’s AIME is $8,789.19.

We’re not done yet! Next time, we’ll look at how your AIME translates into your Primary Insurance Amount (PIA).

Meanwhile, learn more about incorporating Social Security into your retirement portfolio.