If you are a Sensible Financial client, you have likely signed one of our agreements or a form from your custodian, electronically. Electronically reviewing and signing forms provides convenience, security, and speed. The benefits don’t end there, however. Did you know using e-signature services like DocuSign reduce our (and your) impact on the environment?

Sensible Financial adopted electronic signatures in 2016 and we have increased our use of electronic signatures each year since. Currently, Sensible Financial offers all its forms and agreements for electronic review and signature. In addition, our primary custodians (Fidelity and TDA) provide the option to sign electronically via DocuSign.

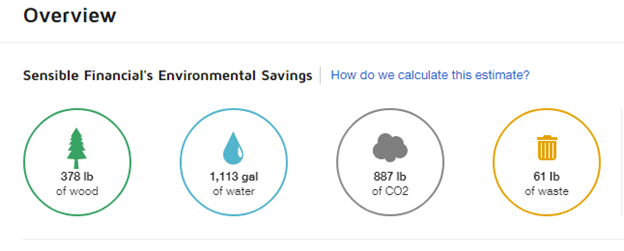

DocuSign provides Sensible with information about how their service helps the environment. They send us a yearly report, documenting the resources we save by encouraging our clients to go paperless. For instance, from November 1st, 2019 to October 2020, Sensible Financial sent more than 500 “envelopes” via DocuSign, translating to an environmental savings of:

- 378lbs of wood

- 1,133 gallons of water

- 887lbs of CO2

- 61lbs of waste

How does DocuSign calculate environmental savings?

DocuSign subscribes to Paper Calculator, an online tool, allowing users to calculate the estimated environmental impacts of their paper choices and usage. Paper Calculator uses life cycle assessment (LCA) to gauge the environmental impact of the entire life cycle of a product. It evaluates the extracting or gathering of the raw material to the processing and manufacture of the item to its disposal. LCA provides data and enables consumers to compare different types and sources of paper.

In addition to offering e-signature to our clients, Sensible Financial offers an optional “Sustainable” model in our investment portfolios. This model includes mutual funds that consider investors’ environmental values. Please talk with your advisor if you are interested in learning more.

Thank you for your help in reducing our environmental footprint!