Sensible Financial has been undertaking a thorough review of custodians in response to changing conditions with three of the leading industry providers. As a reminder, a custodian is a financial institution that holds customers’ securities for safekeeping. In conjunction with (often affiliated) broker/dealers, custodians also execute transactions entered by Sensible Financial, and provide other services such as account administration, transaction settlement, collection of dividends and interest payments, and tax support.

Sensible Financial currently works with two of the leading custodians: Fidelity and TD Ameritrade, and with TIAA, an insurance company that provides retirement plans (primarily to non-profit organizations).

Here are the relevant changes in the industry.

- Fidelity will add a new fee.

- Charles Schwab recently acquired TD Ameritrade.

Sensible Financial is communicating with clients about these developments and will provide a customized analysis showing the costs and benefits of these two custodians, plus a third that we will soon start offering.

As a part of our analysis, we surveyed our clients about their experiences with, and impressions of, custodians. 85 clients responded to our survey, providing valuable input to our process.

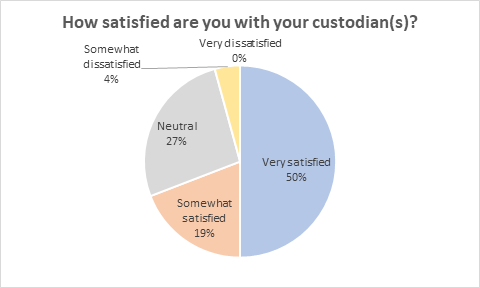

Overall, the news is good. Of clients who have an opinion about the custodian(s) they use, less than 5% are “somewhat dissatisfied” and no one is “very dissatisfied”. Half give their custodian a “very satisfied” mark, the highest survey option.

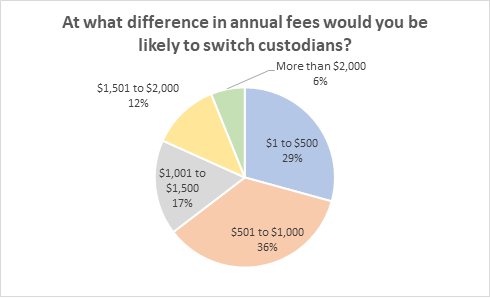

The survey provides us a glimpse into how clients use their custodian’s services. Only one out of 25 clients check their accounts (on the custodian’s website) daily, with the largest group, 43%, checking their accounts “a few times a year”. 82% of respondents said it was “not at all important” to be able to visit a branch office of their custodian. That makes sense given that Sensible Financial takes care of most service items for its clients. Almost half of respondents (47%) said that in the years working with Sensible Financial, they had never visited a branch office of the custodian, used the custodian’s mobile app, or called the custodian without their advisor on the line. Over the years, Sensible Financial has underscored for clients that controlling costs is a reliable way of improving one’s net investment returns. When we asked our clients, what was most important to them in a custodian, “price” and “service” comprised the top two spots, with “reputation” third. As regards price, our clients showed a willingness to switch custodians to avoid higher fees. 65% of respondents would switch custodians to save $1,000 or less per year in fees. In their comments, several clients referred to custodians as “a commodity” for which they were not willing to pay extra.

Sensible Financial is taking our analysis of the custodians very seriously, as you would expect us to. 52% of survey respondents replied that, “I would prefer to rely on Sensible Financial’s recommendation [of custodian]”, and 48% said they would, “take Sensible Financial’s views into account in making my own decision.” No one said that they would “rely on their own assessment”.

The survey provided an opportunity for clients to give answers to qualitative questions, and advisors also had a number of follow-up phone conversations. We gleaned valuable nuances about clients’ views from those discussions.

Sensible clients will hear from their advisor in the coming weeks with customized information that will help them decide whether to remain with their current custodian, or to switch. If you have any questions, please contact your advisor.