In my first article on Social Security, I described how the program works and reviewed the program’s financial standing over the last thirty years. In my second article, I examined the financial future of Social Security and the policy changes necessary to shore up the program’s long-term finances. Here, I outline Sensible Financial’s new projections regarding Social Security and describe how they affect the advice we give our clients. In what follows, I hope to provide you with a clearer sense of how Social Security may change in the future and what this means for your financial plan.

Social Security’s coming insolvency

At first glance, the Social Security program appears to be running quite smoothly. Program receipts have been greater than expenditures for the last thirty years and benefits continue to be paid as promised. However, the Trustees of the Social Security trust fund (“Trustees”) predict program expenditures will surpass receipts by 2022 and the program will be unable to fully cover benefit payments by 2034. If Social Security taxes are to fund benefits over the next 75 years, the program needs to come up with $12.5 trillion. That’s nearly 1% of the country’s projected GDP over that time! To do so, Congress will need to reform Social Security by increasing taxes, reducing benefits, or both.

History may be a guide to future reforms

Historically, major Congressional amendments to Social Security have 1) occurred only when short-term insolvency of the program was imminent, 2) employed a balance of cost cutting and revenue generating measures, and 3) aimed to restore the program’s financial solvency over a period of about 50 years. The 1977 and 1983 amendments to Social Security are two examples.[1]

In their 1975 report to Congress, the Trustees forecast depletion of the Social Security trust fund by 1979. This was just 44 years after the program was originally created. At the time, a poor economy, the demographics of the baby boom, and legislation in 1972 that generously increased benefits all contributed to the program’s funding issue. In response, Congress passed amendments in 1977 to restore the long-term solvency of the program. The amendments raised the Social Security payroll tax rate, increased the wage base, and reduced benefits slightly.

Although these fixes restored the long-term balance of the program, higher than expected inflation (which increased benefit payments) and lower than expected wages (which lowered payroll tax receipts) produced severe short-term financing problems—so much so that the program was forecast to be unable to fully cover benefit payments by 1983. In response, Congress passed last-minute amendments in 1983 to restore the short-term solvency of the program. The amendments legislated the taxation of benefits and put in place a gradual increase in the full retirement age.

Today the program is heading towards insolvency again. By 2034 the Trustees project that the program will be unable to fully cover its benefit payments. This means that Congress will need to pass legislation no later than 2034 to keep the program financially solvent. Unsurprisingly, 2034 marks the 51st year since the 1983 Amendments!

Expect Congress to procrastinate

Unfortunately, Congress has little incentive to implement major legislative reforms to shore up the program’s long-term finances, let alone to make the program financially stable indefinitely. Congress hates to raise taxes and cut benefits, as both are unpopular with voters. History illustrates that Congress prefers to put these actions off as long as possible. When action is taken, it is much easier and less expensive for Congress to temporarily fund the program than to make it financially solvent indefinitely.[2] If history repeats, when Congress does implement reform, it is likely to shore up the program’s finances for about 50 years, as it did when the program first started and again in 1977/1983.

Plan for a reduction in benefits and an increase in taxes

Around 2034, when trust fund assets are forecast for depletion, we assume Congress will enact legislation that balances tax increases and benefit reductions sufficiently to fund the program for the following 50 years.[3] Based on projections by the Trustees, such legislation would entail a permanent increase of about 2 percentage points in the Social Security payroll tax rate (from its current rate of 12.4% to 14.4%) and a permanent decrease of about 11.5% in scheduled benefits for all current and future beneficiaries.[4] [5]

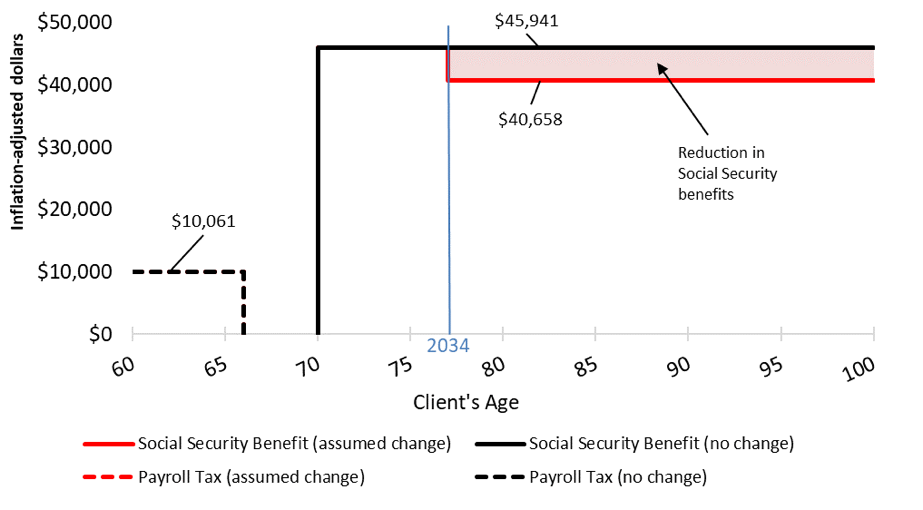

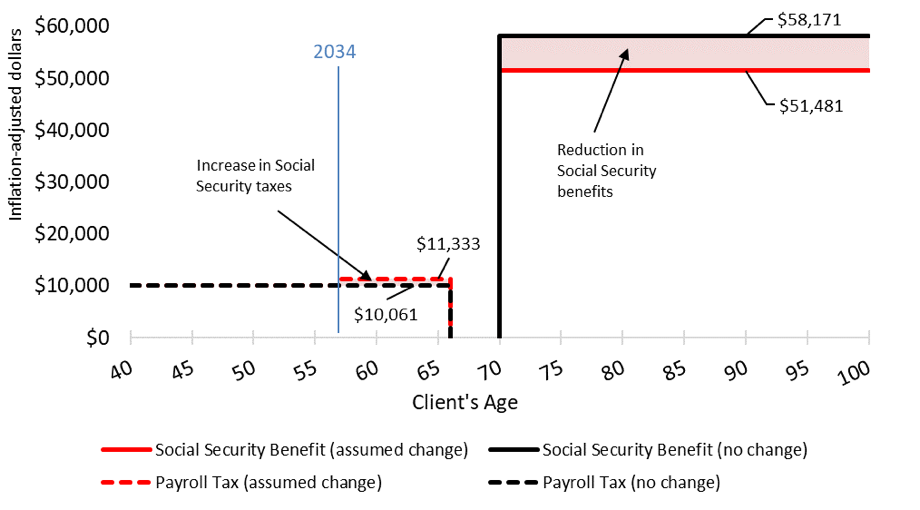

What do these projections mean for you and your financial plan? The answer depends on your age. The closer you are to filing for Social Security retirement benefits, the smaller the impact these projections will have on your living standard (i.e., how much you can afford to spend each year on day-to-day living expenses).[6] Because we expect Congress to delay passing legislation until the trust fund nears depletion in 2034, younger people are likely to experience a larger impact. For instance, under our projections, a 60-year-old will not experience an increase in payroll taxes before retirement and will not experience a Social Security benefit reduction until several years after receiving their first benefit check (see Figure 1). On the other hand, a 40-year-old would experience both an increase in payroll taxes before retirement and a reduced Social Security benefit for every year in retirement (see Figure 2). (The specific numbers shown for benefits and taxes in the figures below are those projected for an individual earning $200k a year in inflation-adjusted dollars over their career.)

Figure 1. Under our projections, a 60-year-old would see an 11.5% Social Security benefit decrease in 2034, but no change in payroll taxes.

Figure 2. Under our projections, a 40-year-old would see an 11.5% Social Security benefit decrease in retirement and a payroll tax increase in 2034.[7]

Planning for future changes to Social Security means planning for lower lifetime after-tax income. All else equal, this means less spending starting now and more saving until retirement.

Our projections translate to a reduction in lifetime Social Security benefits and an increase in lifetime Social Security taxes (see red shaded areas in above figures). Together, this means less lifetime after-tax income: your annual living standard from now through the end of retirement is likely to be from $1,500 to $4,000 lower than it would be if the Social Security program could keep its promises. Younger and higher earning individuals will see a decline at the upper end of the range, while older and lower earning individuals will see a decline at the lower end. Households with more than one adult will also see a larger decline.[8]

Conclusion

The Social Security program requires serious reform. Without it, the program will be unable to fully pay benefits beginning in 2034. History suggests that Congress will act to reform Social Security temporarily by enacting a balance of tax increases and benefit reductions only when the program’s short-term insolvency is imminent. In the past, for financial planning clients, Sensible Financial assumed that Social Security benefits would decline by about 20% around 2033. This was based on projections by the Board of Trustees (at the time) that when trust fund assets were depleted payroll taxes would cover only about 80% of all scheduled benefits.

For new and ongoing financial planning clients, Sensible Financial is now updating our assumptions regarding Social Security. Based on analysis published by the Board of Trustees, Sensible Financial projects that the Social Security payroll tax rate will increase by about 2 percentage points from its current rate of 12.4% to 14.4% and benefits will decrease by about 11.5% (for all current and future beneficiaries) beginning in 2034.

We believe that accounting for realistic changes to Social Security is good planning. Depending on your age and earnings, our projections imply a reduction in your annual living standard between $1,500 to $4,000. This means you will have about $125 to $333 a month less (after-tax) to spend on your living standard, now through the end of retirement, than if you assumed there were no changes to Social Security. For households with more than one adult, this amount will be higher.

Prediction is difficult, especially about the future: A Disclaimer

When it comes to the economic assumptions we use in our client’s financial plans, such as those around Social Security, I must warn you against the illusion of precision. Although we strive to develop projections grounded in real-world data and credible research, we recognize that your actual experience is likely to be different. This is only natural, given the inherent uncertainty of the future. Ultimately, the process of planning for the future is more important than the accuracy of your plan. “Things will change, but with every decision you make, you’ll be a little less wrong.”[9]

To speak with an advisor about planning for your financial future, contact us!