How does it affect your bottom line?

This information is not intended to be individual advice. We recommend that you consult with your accountant/financial advisor/attorney before implementing any of the strategies we discuss below.

Figuring out whether to buy or rent a home can feel less like comparing apples and oranges and more like comparing apples and bicycles. When you buy a home, you invest a large sum of money once, and then pay lots of monthly and annual expenses. When you rent, you pay a much smaller monthly amount than the purchase price, and perhaps a different set of monthly expenses. Fortunately, there are ways to explore the decision and, indeed, compare an apple and a bicycle.

Housing takes up a large percentage of most people’s budgets, and where you live profoundly affects your daily life, so choosing between buying and renting can be stressful. Making this decision in retirement adds an additional complication because you’re no longer earning income from work.

This article is based on a webinar I presented about renting vs. buying a home in retirement. View the recording here.

Retirement housing considerations

Whether you rent or buy, there are a few factors to consider for housing in retirement. For one, you need to plan for physical aging. When you’re 85, a single-story ranch will be more comfortable than, say, a Victorian with a teetering staircase.

As you get older, your emotional energy will also diminish and it will get harder to adapt to change. You’ll want a housing solution that meets your needs and doesn’t require you to make big changes.

Now you know what to look for in retirement housing. But should you rent or buy? Let’s look at an example.

Buying vs. renting: The Robinsons

Joan and Mark Robinson are both 68 years old and plan to retire at 70. They live in a Boston suburb. Joan earns $100,000 a year as an architect; Mark makes $90,000 as an accountant. Their sustainable consumption – that is, how much they can spend every year on non-fixed expenses like food, clothes, and travel – is $65,000 a year. On top of their earnings, the Robinsons have amassed large 401(k)s and savings accounts worth $2,050,000.

The Robinsons’ $1 million family home has become too big for them. Their kids, Jessica and Theodore, have grown up and moved away, so Joan and Mark plan to sell it and move somewhere smaller. But should they buy or rent?

We enter data about the Robinsons’ finances into MaxiFi, a financial planning software, to analyze their finances and help the Robinsons decide.

Advantages of buying vs. renting

There are advantages to both options. We ask the Robinsons which advantages they value more.

Buying:

- Financial advantages:

- Forced saving. Buying a house requires you to be more financially responsible to come up with a down payment.

- Tax advantage. The IRS does not tax imputed rent as income. Imputed rent is the amount homeowners would pay to rent a comparable home.

- Potential appreciation. When you sell your home, you keep any value it has accrued.

- Emotional advantages:

- Real assets are tangible. A house feels less risky than a financial asset because it’s a physical object you can touch.

- Rooted feeling. When you own your home, it feels more permanent. You can modify the house without asking a landlord.

- Bequest. You can leave the house to your heirs.

- Shared family experience. Owning a house makes it easy to stay in the same place for many years, giving continuity to your family’s memories.

Renting:

- Financial advantages:

- Flexibility. The transaction costs of renting are lower. You don’t necessarily pay a commission to the real estate agent.

- No concentrated investment. Because you’re paying smaller amounts monthly, you can invest in a diversified portfolio instead.

- No potential loss. Renting protects you from fluctuations in the value of your home.

- Emotional advantages:

- Less commitment. You’re not tied down by homeownership and can move to another city or state whenever your lease ends.

- No worries. The landlord is responsible for maintaining the property.

The imputed rent in homeownership

What are you getting when you buy a house? You get the physical property, but you also get a stream of housing services while you own it. Think of the house’s purchase price as the sum of all the future years of housing services.

Take a house which depreciates at two percent a year and would rent for $20,300 a year. With a real interest rate of about half a percent, that would give a notional house value of about $750,000.

$750,000 for a long time and $20,300 for this year don’t intuitively feel similar, but that’s how we should compare buying and renting.

A homeowner gets housing services from their home until they sell it. However, investing in real estate is risky. And, if they want to keep the house from depreciating, they must put money into maintenance. A renter, on the other hand, pays the owner for the housing services, the opportunity cost, and maintenance.

Let’s break down the costs of each option.

Costs of buying vs. renting

Buying:

- Transaction costs:

- Broker’s commission

- Settlement costs (appraisal, title insurance)

- Ongoing costs:

- Real estate taxes

- Homeowner’s insurance (structure and contents)

- Major maintenance (depreciation)

- Minor maintenance

- Utilities

- Opportunity cost of investment

Rent:

- Transaction costs:

- Broker’s commission

- Ongoing costs:

- Rent

- Renter’s insurance (contents)

- Utilities

Comparison of buying vs. renting

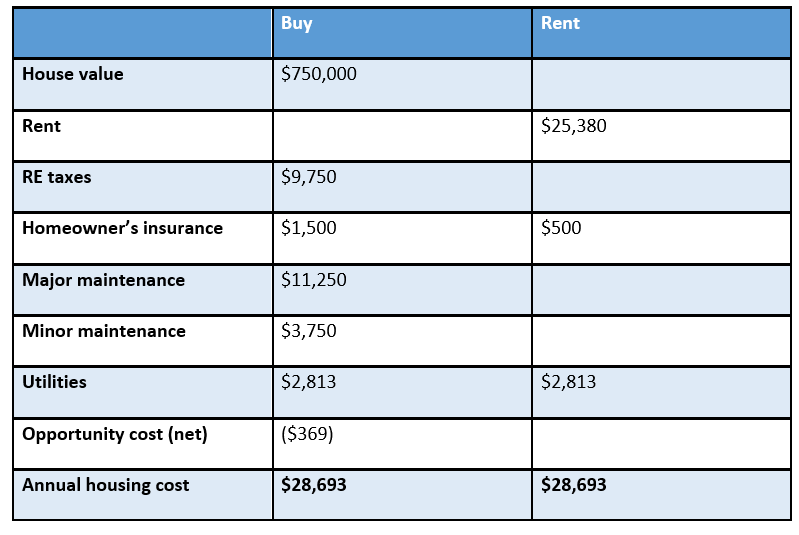

The Robinsons are comparing two houses of similar value – one to rent and one to buy. Here’s how their options stack up.

I’ve made the annual costs the same so the difference between buying and renting is clearer. Having them be the same might seem unclear, but it makes sense when we look at the Robinsons’ future annual consumption.

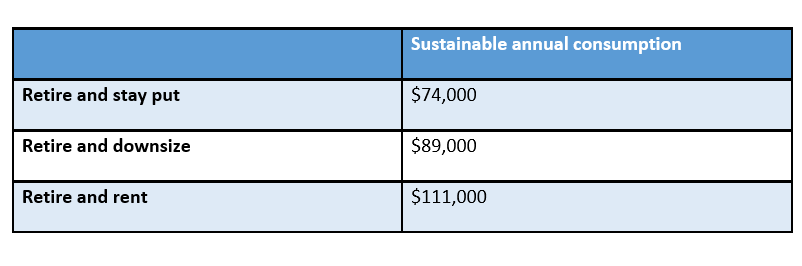

If the annual costs are the same, but renting lets them spend $22,000 more a year than buying, it seems like an obvious choice to rent. However, there’s a catch. Those extra funds come from the assets they would have used to buy a house. If they spend it all, they’re left with no home equity to tap for emergency expenses, and nothing to bequeath to their kids.

Renting with a reserve fund

The Robinsons don’t need to spend $111,000 a year. They could establish a reserve fund instead. When they sell their current home, they can set aside $734,403 (the amount they would be bequeathing if they bought a smaller home) in a taxable account and promise themselves they won’t spend it except for gifts, unexpected emergencies, or a bequest.

If the Robinsons establish a reserve fund, they’ll have assets left over to spend $87,000 a year in retirement.

Once they hold back that reserve fund to leave to their kids or tap into in emergencies, buying and renting look pretty much the same. However, there are tax and investment implications for each option.

Downsizing vs. renting with a reserve fund

The advantages and disadvantages of each option are different, but for the Robinsons, they wind up being similar.

Tax implications:

- Housing services are not taxable income

- Capital gains taxes on the house are deferred, and step-up in basis or allowance may eliminate them

- Income to the reserve fund is taxable

Investment implications:

- A home is not diversified – it’s one asset class in one location

- The reserve fund investment can be very diversified

What’s the answer?

Comparing buying and renting can seem confusing. By breaking the one-time cost of buying a house into a yearly cost, it’s easier to see how it stacks up to renting.

In the end, choosing between renting and buying depends on your needs and abilities. If you want the flexibility to move around the country and have the discipline to set money aside every year, you might prefer renting. If you want the comfort and stability of owning your home and you’re willing to take on the full cost of ownership (including maintenance and the risk of undiversified investment), you might prefer to buy.

Do you need advice about choosing to buy or rent a home or planning another aspect of your financial future? Sensible Financial is here to advise you. Request an appointment with one of our experts and we can figure it out together.

Photo by Jaye Haych on Unsplash