In the second of our series of articles taking a deep dive into the last two decades of investment history, we’ll look at international and emerging markets. The first article focused on US stock and bond investing from 2000 to 2019.

This article originally appeared in Forbes.

International (developed) and emerging markets offer potential diversification benefits. By incorporating non-US stocks into our portfolios, we hope for approximately the same return and some risk reduction.

Non-US stocks outperformed US stocks in the aughts but trailed in the teens

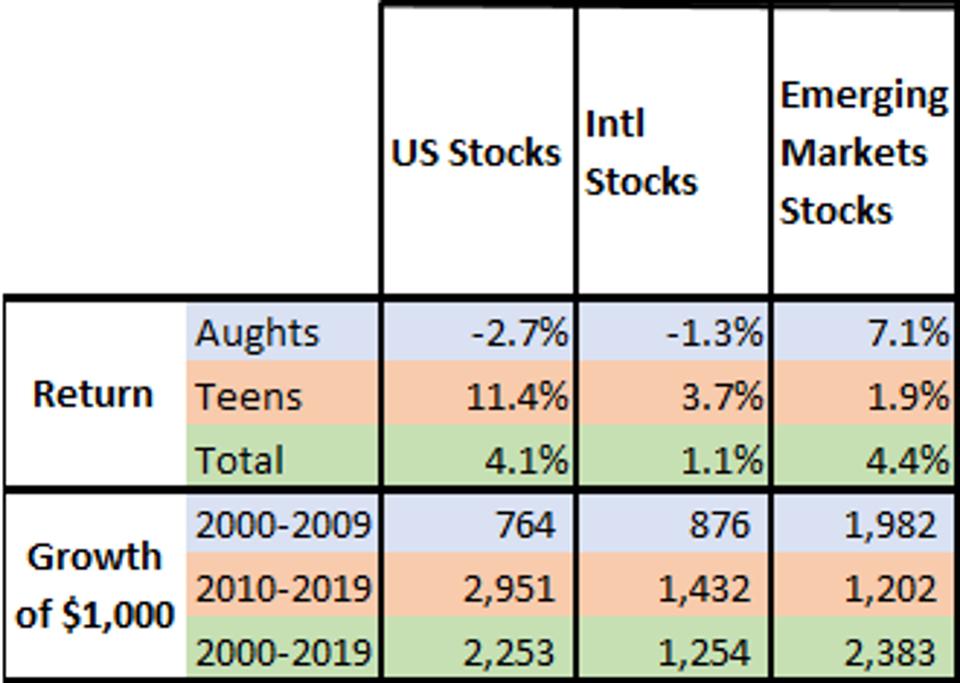

Results for these broad categories differed from US stock returns as dramatically as US bonds did. In the aughts, international stocks (the MSCI EAFE index, net dividends – meaning reinvesting dividends net of taxes) outperformed US stocks. Emerging markets (MSCI Emerging Markets Index net dividends) had very favorable results, outperforming US stocks by nearly 10% per year (!).

Investing $1,000 in US stocks would have yielded $764 at the end of 2009. Investing that same $1,000 in emerging markets stocks would have resulted in $1,982, more than 2.5 times as much. A $1000 investment in international stocks would have yielded $876.

In the teens, the ranking reversed. US stocks outperformed both international and emerging markets stocks, while emerging markets stocks barely matched US bond returns (see previous article). For the full two decades, the enormous lead emerging markets developed in the aughts was sufficient to eke out a slight advantage for the full two decades. International stocks trailed US stocks in the teens and overall.

International and emerging market stocks can be valuable diversifiers for US stocks, but not every year.

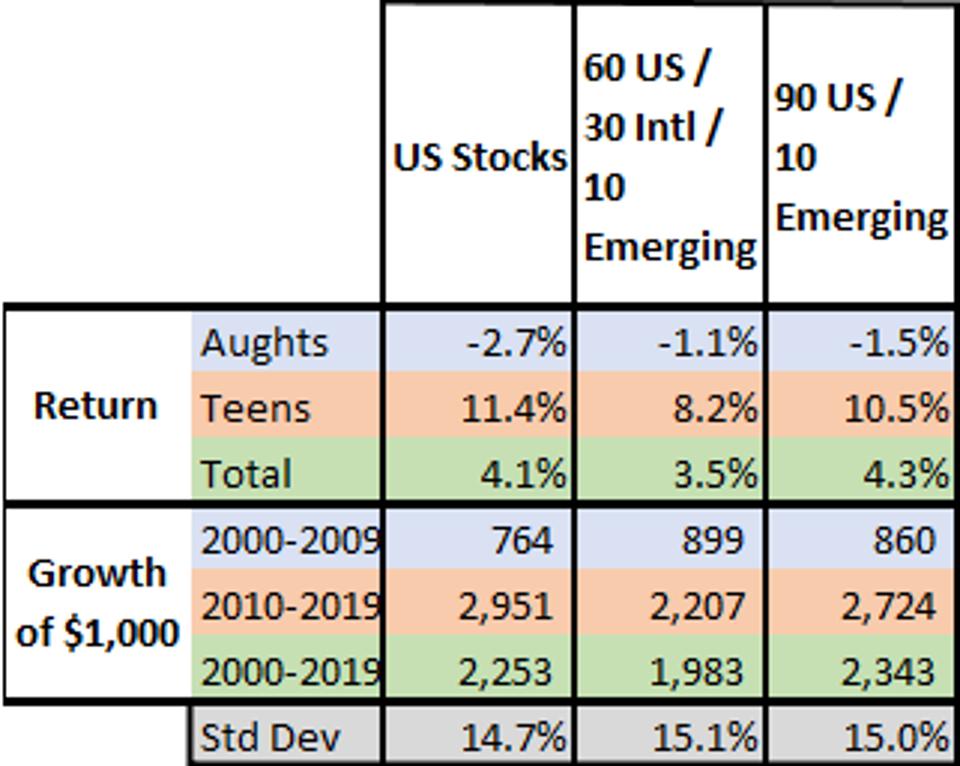

- Global portfolios benefitted from diversification in the aughts but didn’t do as well as US-only portfolios in the teens.

- The global portfolio’s risk was slightly larger than for a US-only portfolio.

As we said, investors hold non-US assets not for extra return, but for risk reduction. Compare the last two columns, one representing a portfolio of 60% US stocks, 30% international stocks and 10% emerging market stocks, the second a 90% US and 10% emerging markets portfolio, to the US stocks only portfolio in the first column. Both diversified portfolios had slightly greater standard deviations (more risk) than a US-only portfolio had, and the 60/30/10 portfolio underperformed the US-only portfolio.

Should we abandon global diversification? After all, it didn’t “work” over two full decades! Maybe we should abandon International stocks, and just invest in Emerging Markets (the 90/10 portfolio outperformed US-only both in the aughts and overall).

However, in the aughts the 60/30/10 portfolio earned substantially higher returns (or took substantially smaller losses) than the US-only portfolio (and even somewhat better than the 90/10), and the risk was only slightly greater for the two decades. I’m disappointed that results weren’t better and risk reduction didn’t materialize, but I still think the strategy is sound.

As in the case of US stocks and bonds, basing investment decisions for the teens on the ten years of returns in the aughts would not have been a good idea: increasing emphasis on international and emerging markets stocks and decreasing US stock allocations would have been a losing strategy in the teens.