Once your assets can fund your post-retirement spending, you’re ready to retire. But how do you know when you have enough? In other words, what’s your number?

The author Lee Eisenberg made “the number” concept famous in 2006 with his bestselling book “The Number: A Completely Different Way to Think About the Rest of Your Life”. The number in question was net worth. However, the book is about more than just accumulating assets. Eisenberg emphasizes thinking through all your retirement priorities, not just your finances. And there isn’t just one number; the larger your number is the earlier you can retire.

This article is based on my webinar series about how to get ready for retirement. Click here to watch When Can I Retire: What’s My Retirement Number?

Retirement number example: the Yalls

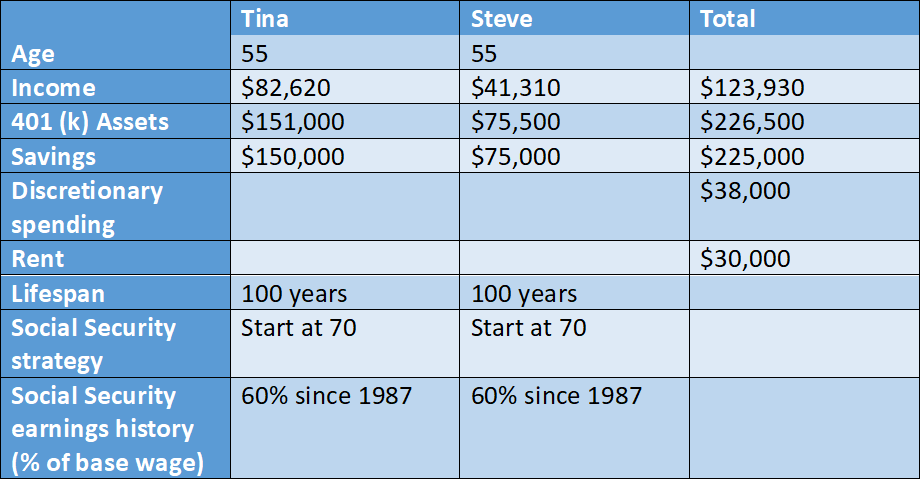

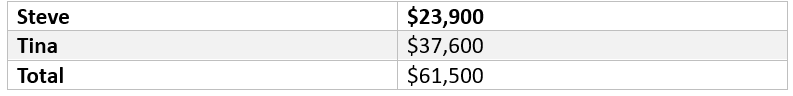

Here are the pertinent numbers for the Yalls.

Our economic assumptions in this example are that taxes and Social Security will continue in their current trend. We assume interest rates will be about .05 percent, and that inflation will be about two percent.

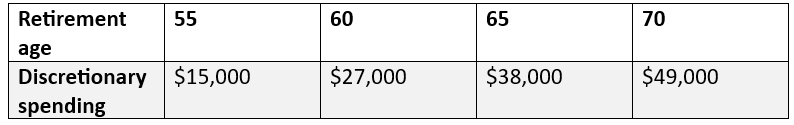

Let’s see how the number changes for Tina and Steve based on the age at which they choose to retire. First, look at how much discretionary spending they’ll be able to afford if their earnings remain consistent.

Their current discretionary spending is $38,000 a year, so an early retirement at age 55 would be rather disappointing. Retiring at 65 will let them maintain their current spending, so that’s what we recommend.

Finding the right age to retire

Imagine if the Yalls decided to ignore our advice, retire early at 55, and continue spending $38,000 a year. They’ll use up their non-retirement assets at about age 59. That would be a big mistake! By age 63, they would be completely out of funds. They would have to start their Social Security benefits then, and they would have to cut their spending and rent significantly to get by. It would not be fun.

Alternately, if they retire at 65, everything will work perfectly. Their assets will grow to about $800,000 by the time they retire at 65. Between their savings and Social Security, they’ll have enough assets to live to age 100. That makes for a well-planned retirement, with far less drama.

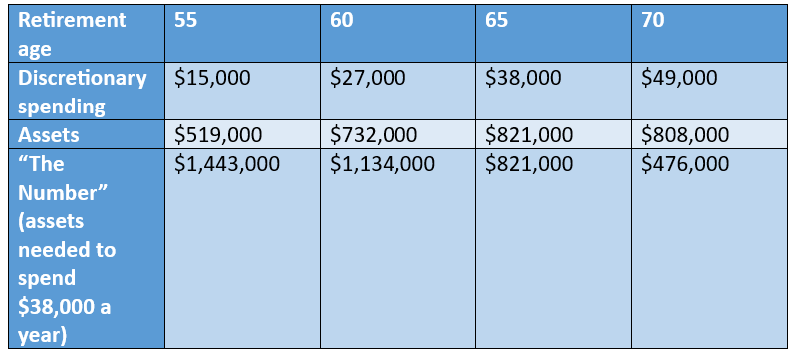

Here’s the assets the Yalls would have if they retired at different ages and planned to spend what they could afford.

Since they want to spend $38,000 a year and retire at 65, $821,000 is the Yalls’ number as defined by Eisenberg. If they want to retire at 55 and keep spending the same amount, their number is $1,443,000. To maintain their lifestyle, they would need to find another $924,000 somewhere. That’s not so easy unless you have a rich relative, or you win the lottery!

Filling the Social Security gap

Another way to think about the number is to calculate from the bottom up.

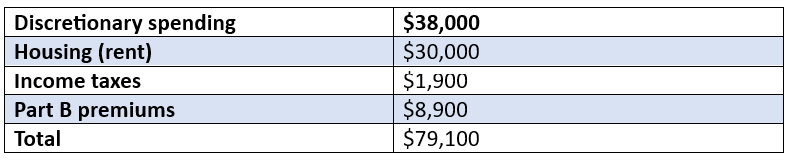

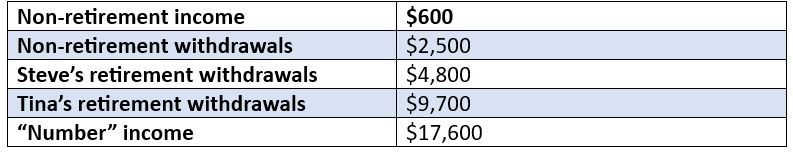

To get the Yalls’ number for retiring at 70 years old, we add up their discretionary spending, housing, Medicare part B premiums, and income taxes for retirement (ages 70 to 100) and average them.

In addition to their assets, Steve and Tina will get Social Security benefits. Here’s their social yearly security income:

The difference between the Yalls’ Social Security income and their total retirement spending is $17,600 a year. How will they fill in that gap?

The Yalls will draw $17,600 from their portfolio each year, just enough to make up the difference. Most of their income after age 70 will come from Social Security. Only about 22 percent comes from their assets. However, every year before they can start receiving Social Security income, 100 percent of their retirement income will have to come from their assets. That’s why retiring early would be so costly for them.

Finding your retirement number

Using the Yalls as an example, you can figure out your own retirement number. The Social Security Administration offers a calculator to estimate what your Social Security benefits will be. Then you just need to plug in your income, intended retirement spending, and retirement age, and you’ll be on the way to your number. If it’s too high, you might need to retire later. If it’s low, lucky you! You can retire sooner or spend more in retirement.

If you want help planning your retirement, Sensible Financial is here to advise you. Request an appointment with one of our experts and we can figure it out together.

This information is not intended to be personal advice. We recommend that you consult with your accountant before implementing any of the strategies we discuss here.