For at least a year now, Sensible Financial has been advising its clients to create and then “lock down” their my Social Security Account. This account is located on the Social Security Administration’s web site, www.ssa.gov. Since September 29, 2018, your my Social Security account has been the only way to apply for Social Security and Medicare benefits online. Whether you are creating this account, or logging into an account you previously created, the web site [Learn more…]

Social Security

How Much Can I Plan on Social Security?

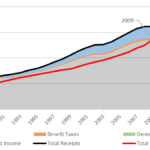

In my first article on Social Security, I described how the program works and reviewed the program’s financial standing over the last thirty years. In my second article, I examined the financial future of Social Security and the policy changes necessary to shore up the program’s long-term finances. Here, I outline Sensible Financial’s new projections [Learn more…]

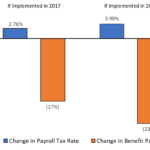

What It Will Take to Fix Social Security’s $12.5 Trillion Shortfall

In my previous article, I describe how the Social Security program works and examine the program’s financial standing over the last thirty years. Currently, Social Security is running a small annual surplus, paying benefits as scheduled, and trust fund reserves are larger than they’ve been in decades. At a glance, everything appears A-ok. However, the [Learn more…]

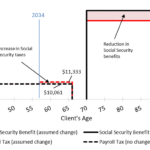

How Social Security’s Coming Insolvency Will Affect You

It is no secret that the Social Security program is financially unsustainable. Based on current projections, too little cash is coming in to cover future benefit payments. The first page of your Social Security Statement (the document reporting your lifetime earnings history and estimating your future Social Security benefit) states that “by 2034, the payroll [Learn more…]

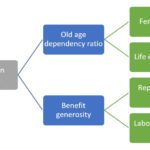

Just How Good is Social Security, Anyway?

Axel Börsch-Supan, a German expert on public pensions, spoke at the 18th Annual Meeting of the Retirement Research Consortium in Washington, DC earlier this month. He offered an implicit framework for how public pension systems should work. He suggested that these systems should: Be operationally transparent Automatically adjust to changes in the supporting economy Not [Learn more…]

The Other One Percent – Part 3 (The Value of Waiting)

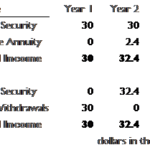

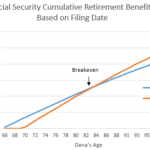

This Part 3, of a 3-part series, read the other parts here: Part 1, Part 2. In my previous two articles, I talked about both the relatively small number of Americans who delay receiving Social Security until age 70 (the age that would maximize their benefit), here, and how a breakeven analysis of Social Security [Learn more…]

The Other One Percent – Part 2

This is Part 2, of a 3-part series, read the other parts here: Part 1, Part 3. In my previous article, I noted the (surprising) fact that although most financial planners recommend people delay filing for Social Security until age 70, when the benefit will be highest, only about 1% of Americans actually do this. [Learn more…]