When you stop working, you could have a lot more time on your hands. Maybe you want to spend some of that time in a seaside cottage, a cozy cabin in the woods, or a luxurious lake house. But is buying a retirement vacation home a good idea? As with most financial and life decisions, it depends on your situation.

This article is based on a webinar series I presented about housing options in retirement. You can view the recording here.

Retirement housing considerations

The vacation home you want in your 70s could be quite different from what you wanted in your 20s – there are new factors to consider. For one, you need to plan for physical aging. When you’re 85, a single-story ranch will be more comfortable than, say, a Victorian with a teetering staircase.

As you get older, your emotional energy will also diminish. It gets harder to adapt to change. You’ll want a house that can adapt to your needs without requiring you to make big changes.

Okay, so you know what to look for in a vacation home. But should you buy one? Let’s look at an example.

Example of buying a retirement vacation home: The Robinsons

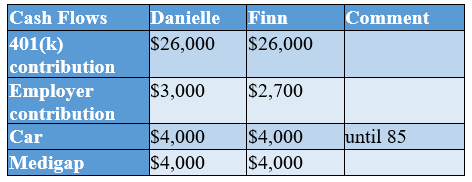

Danielle and Finn Robinson are both 68 years old. They live in a Boston suburb. Danielle earns $100,000 a year as an architect; Finn makes $90,000 as an accountant. They plan to retire and start drawing Social Security benefits at age 70.

The Robinsons’ $1 million family home feels too big since their kids have grown up and moved away, so Danielle and Finn are planning to sell it and move to a smaller house. They’re also considering buying a vacation home.

They are saving regularly, and they have few fixed expenses. The Robinsons have amassed large 401(k)s and savings accounts. But how do they know if buying a vacation home is the right decision for them?

What should you ask when considering a vacation home?

As the Robinsons thought about whether to buy a vacation home, here are the questions I encouraged them to consider.

- Why do we want a vacation home?

- How much would it cost to just take vacations where we’re thinking of buying?

- How much do we want to spend on other vacations?

- How much will we use our vacation home?

- Are we willing to rent out our vacation home?

For many people, a vacation home is a romantic ideal. They fantasize about having a house in their favorite destination. It’s important to factor in your dreams when making financial decisions, but you need to consider the practicalities too.

How do you know whether a vacation home is worthwhile financially?

The Robinsons are downsizing from their $1 million house to one that costs $750,000. Since there’ll be money left over, they’re planning to buy a $350,000 condo near their favorite ski mountain. They want to keep the condo for the rest of their lives – when they’re too old to ski, their kids can use it. And they don’t plan to rent it out.

We encouraged the Robinsons to consider all their options. One possibility was taking special vacations. A $13,500 vacation every year from age 70 to age 90 would cost the same as operating the condo, including capital costs, insurance, real estate taxes, major maintenance.

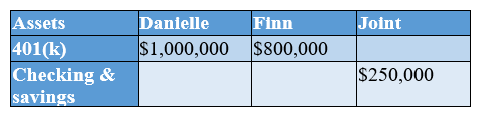

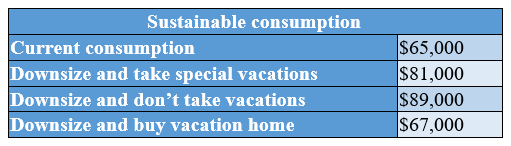

We looked at how the Robinsons’ discretionary spending would change based on their choice. The Robinsons now spend $65,000 a year on consumption goods and services. If they were to downsize without vacationing or buying a vacation home, they could upgrade to spending $89,000 a year.

However, one way or another, the Robinsons want to vacation in retirement. If they choose to take special vacations instead of buying a retirement vacation home, they’ll have to reduce their consumption spending by only $8,000 per year.

Why only $8,000, if the vacations are $13,500? Because they plan to stop vacationing when they turn 90. Owning the vacation home, on the other hand, will cost them $22,000 a year, since they’ll own it until age 100.

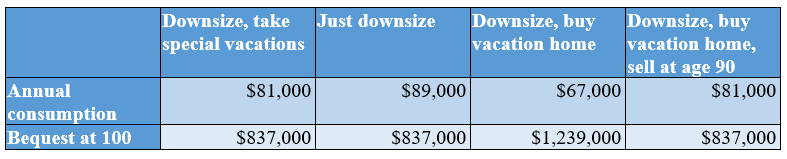

What if they sell the house when they’re 90? The cost (not shown) would be similar to the special vacation approach, though still slightly more expensive because of the costs of selling a house. There’s still one more factor to consider, however.

The bequest

The Robinsons also want to consider the size of their assets at the end of their lives. Assuming they always spend their full consumption amount every year, here are the living standards they could enjoy and the assets they could bequeath to their kids.

In all situations where the Robinsons don’t buy the vacation home, they raise their annual spending and leave their house to their children. (It will have appreciated to $837,000 by the time they turn 100.) If they buy and keep the vacation home, their annual spending stays close to its current level, and they leave both the $837,000 house and their vacation home to their children.

Your housing decisions affect not only how much you have available to you for day-to-day spending, but also how much your heirs will inherit.

Buying a vacation home to diversify your investments

There’s one other financial advantage to owning a second home like a vacation home. It can diversify your real estate holdings. By owning two smaller houses instead of one larger one, you reduce your investment risk. Since the vacation home is likely in another state or region, the values of the two houses correlate less, leaving you less vulnerable to local market fluctuations.

Good reasons to buy a retirement vacation home

The Robinsons still don’t have a straightforward answer. They know they can afford a vacation home in retirement, but is it right for them?

Here are the best reasons to buy a vacation home. If the Robinsons – or you – agree with these reasons, then making the purchase will be worth it.

- We want a special place where our children and grandchildren can visit and build memories.

- We love the area and want to spend most of our vacation time there.

- We have the time, energy, resources, and desire to maintain the house.

- When we don’t use it, we either plan to rent it out OR we can afford to leave it idle.

- We are willing to sell it later in life if we need a financial cushion.

In short, the number one reason to buy a vacation home is that you will use it. If you buy a vacation home and sell it again after a few years because you couldn’t be bothered to spend time there, you will have wasted the transaction and maintenance costs of the property.

You should buy a vacation home only if you can afford it financially and emotionally. It takes a lot of effort to maintain a second home. You have to furnish it, keep it clean, and travel back and forth between it and your primary home. If you don’t love the place, those extra costs can easily become a burden. But if you do love it, and spending time there with your family becomes a special tradition, the costs can be well worth it.

Finally, it’s important to see a vacation home as a source of flexibility. That way, even if it uses up your financial surplus and you plan to keep it until the end of your life, you always have the option to sell it if the need arises.

So, should I buy a retirement vacation home?

In the romantic ideal, a vacation is all pleasure and no cost. In reality, the costs are substantial. For some families, the benefits can outweigh the costs. Some of our clients love their vacation homes and use them all the time. But we also have clients who considered a vacation home and decided they’d rather travel to a wider variety of places.

So, if you’re considering buying a vacation home, don’t just ask yourself “Do we have the assets to afford this?” Also ask “Will we use it?” and “Are we willing to maintain it?”

If you need advice about buying a vacation home or want help planning another aspect of your retirement, Sensible Financial is here to advise you. Request an appointment with one of our experts and we can help you figure it out.

Photo by Cara Fuller on Unsplash