Medicare premiums can include surcharges related to your income. You don’t want to get charged extra if you can avoid it. So, let’s learn how surcharges are calculated and how you can minimize or avoid them.

I presented a webinar on this topic recently. To watch, click Planning to Minimize Medicare Surcharges.

What are Medicare IRMAA surcharges?

You may be familiar with the standard base premiums you pay for the different parts of Medicare. However, many retirees find Medicare surcharges confusing. You may have received a letter from the Social Security Administration (SSA).

This is not a bill! It’s a warning of what to expect for premiums next year. There’s so much information in this letter in such a small font that it can be overwhelming. The information is about the SSA’s determination of your Medicare premiums, potential surcharges, and your appeal rights. These surcharges increase your monthly premiums for Medicare Parts B and D. They are called Income-Related Monthly Adjustment Amounts, or IRMAA.

How are IRMAA surcharges determined and how much can they add to your base Medicare premiums?

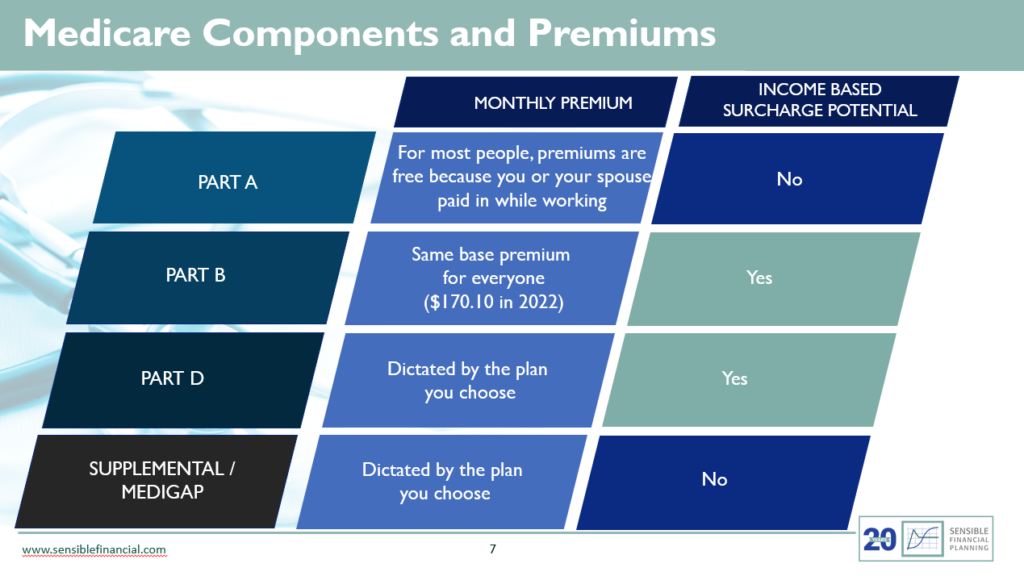

There are different parts to Medicare.

- Medicare Part A (hospital) is free for most people.

- Part B (physician) has the same base premium for everyone ($170.10 per month in 2022).

- Part D (prescription drug) and Medicare Supplemental/Medigap are private insurance policies whose premiums vary depending on the plan you choose.

The only parts with potential for IRMAA surcharges are Part B and Part D.

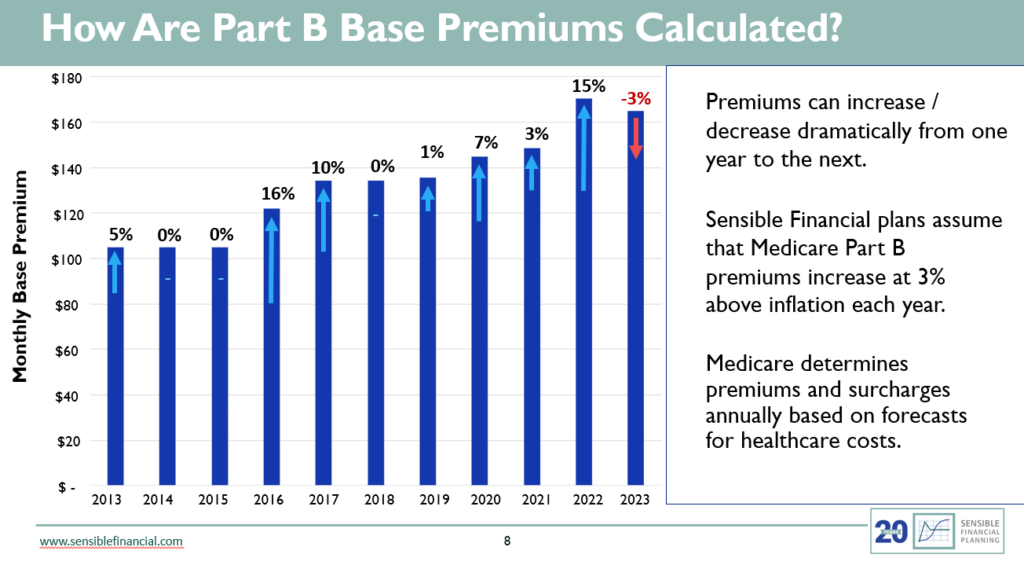

How are Medicare Part B base premiums calculated?

Medicare Part B base premiums can go up, down, or stay the same each year. The trend is for them to increase over time. The SSA determines your Part B base premium from their estimate of the cost of healthcare that year. Not the cost of your healthcare – avoiding doctor visits won’t change the premium – but the cost of healthcare for everyone on Medicare.

IRMAA surcharges for Part B change based on the cost of the Part B base premium. If the base premium goes down, the surcharges go down too.

How do they calculate the Medicare Part B and Part D surcharges?

Part B and Part D surcharges increase when Part B and Part D base premiums increase. But another factor determines the surcharges for you – your modified adjusted gross income (MAGI), which we’ll define more thoroughly. If your MAGI is over a certain threshold, the SSA may add a surcharge.

Every year, the SSA looks at your tax return from two years ago to decide whether you pay a surcharge. Why two years ago?

You start paying premiums for the year in January. The SSA can ask the IRS for your income to determine the surcharge, but the IRS doesn’t know what your income for this year, say 2023, is, because you haven’t earned it yet. The IRS also doesn’t have your income for 2022 because you haven’t filed your tax return yet. Your most recently filed tax return is for 2021, so that’s the one the SSA uses to calculate your MAGI and set your surcharge for 2023.

The SSA sets your IRMAA surcharges annually. Your surcharge will vary from year to year based on your income.

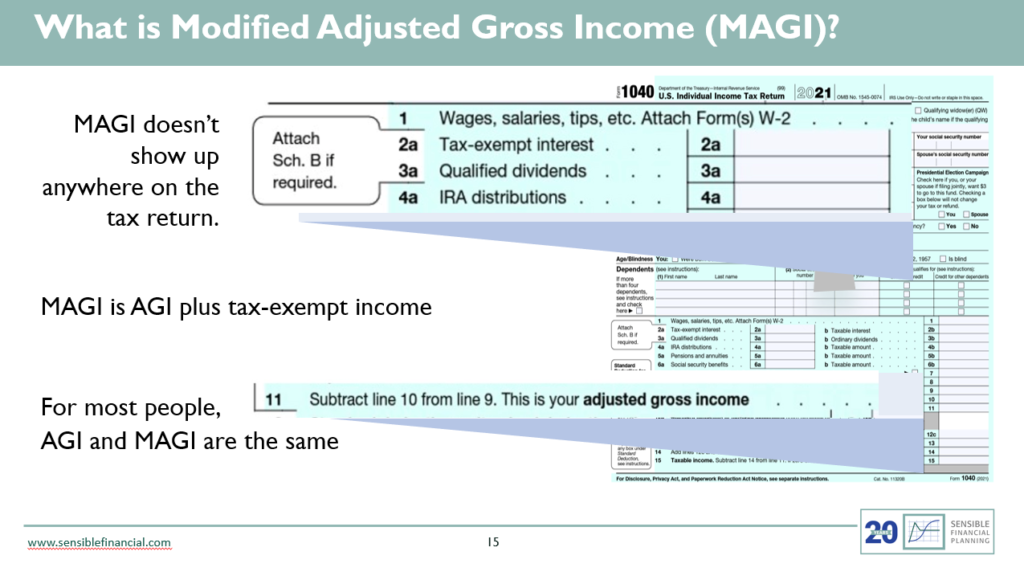

What is MAGI?

SSA uses your modified adjusted gross income, or MAGI, to determine whether you owe premium surcharges for Medicare Part B and Part D. MAGI is based on your adjusted gross income (AGI), but if you look at your tax return, you won’t see a MAGI on there.

Luckily, it’s not too hard to calculate your MAGI.

Add your AGI (line 11 of your tax return) to your tax-exempt interest (line 2a).

Your AGI includes your earnings, taxable interest, dividends, pre-tax IRA draws or distributions, pensions, annuities, the taxable portion of your Social Security, capital gains, and real estate. Tax-exempt interest is not included in your AGI, which is why you add it back in to calculate your MAGI. However, most people don’t have tax-exempt interest, so their AGI and MAGI are the same.

How does your MAGI affect your Medicare surcharges?

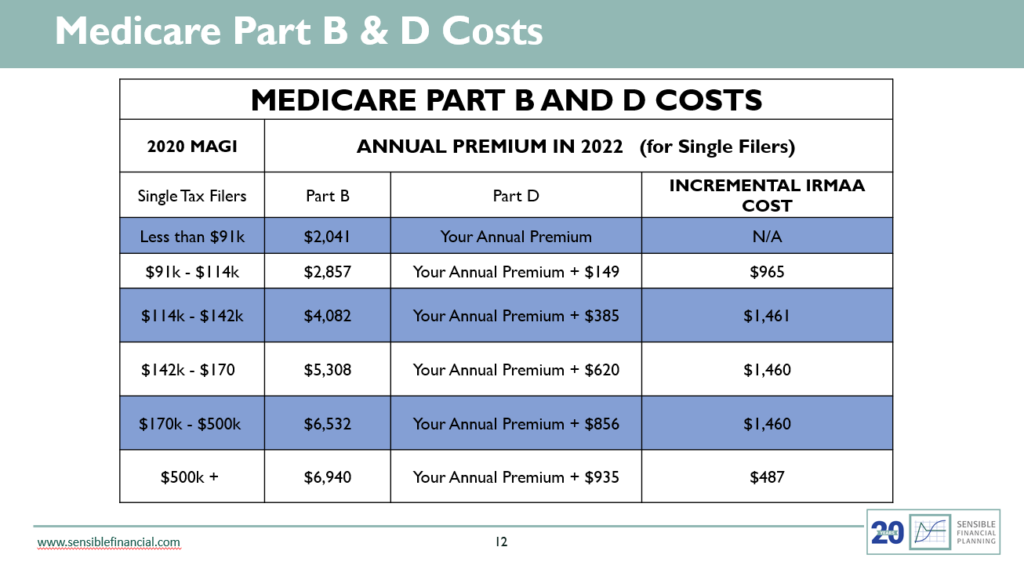

First, find your MAGI bracket on the left side of this table. Note that your annual premium for part B (base and surcharge are combined) and Part D increase as you enter higher MAGI brackets. The incremental IRMAA cost over on the right is additive. If you’re in the highest MAGI bracket, you’ll pay the sum of the numbers in the right column in surcharges. For married couples, surcharges can come to $11,666, or almost $1,000 a month! Fortunately, planning and reducing your MAGI can help lower those surcharges.

Reducing IRMAA surcharges

Sensible Financial recommends you start thinking about future premiums and reducing your MAGI before you retire, and at least two years before starting Medicare. Since the SSA recalculates your surcharges yearly, you can still reduce your surcharges in the future.

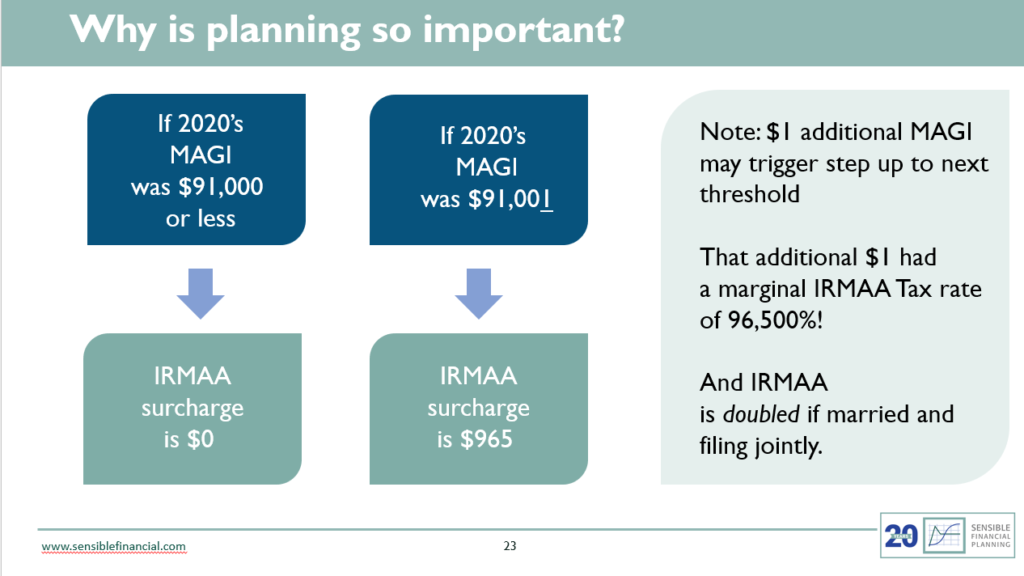

This example shows two different individuals. The first individual has a MAGI of $91,000. Their IRMAA surcharge is zero. The second individual’s MAGI is one dollar more. At $91,001, their IRMAA surcharge is $965. If they’d been filing jointly and income exceeded the first threshold, surcharges would be $1,930. That shows why planning to keep your MAGI in the right bracket is so important.

Types of income and their effect on MAGI

Not all income is created equally when it comes to Medicare surcharges. Some types affect your MAGI more than others.

Income types with no effect on MAGI:

- Cash distributions from a bank

- Roth IRA distributions

- HSA distributions

- Reverse mortgage income

Income types with partial effects on MAGI:

- Social Security

- Brokerage account distributions (with capital gains)

- Sale of a property (with capital gains)

Income types with full effects on MAGI:

- 401k, 403b, 547 and IRA distributions

- Earnings

- Pension income

- Taxable investment

- Savings account interest

Strategies to control your MAGI to minimize IRMAA surcharges

You might need to combine these strategies to avoid, or at least minimize, surcharges. It’s helpful to think holistically and prioritize your overall taxes when planning a strategy. Medicare surcharges are important, but your full tax and premium surcharge picture takes precedence.

Qualified Charitable Distributions (from your IRA)

Qualified Charitable Distributions, or QCDs, are available for people at least 70-and-a-half-years-old who plan to give to charity. A QCD must come from a pre-tax IRA or retirement plan and go directly to a charity. QCDs enable you to give money to charities you care about and satisfy some of your required minimum distribution, without increasing your MAGI.

Structuring your retirement income

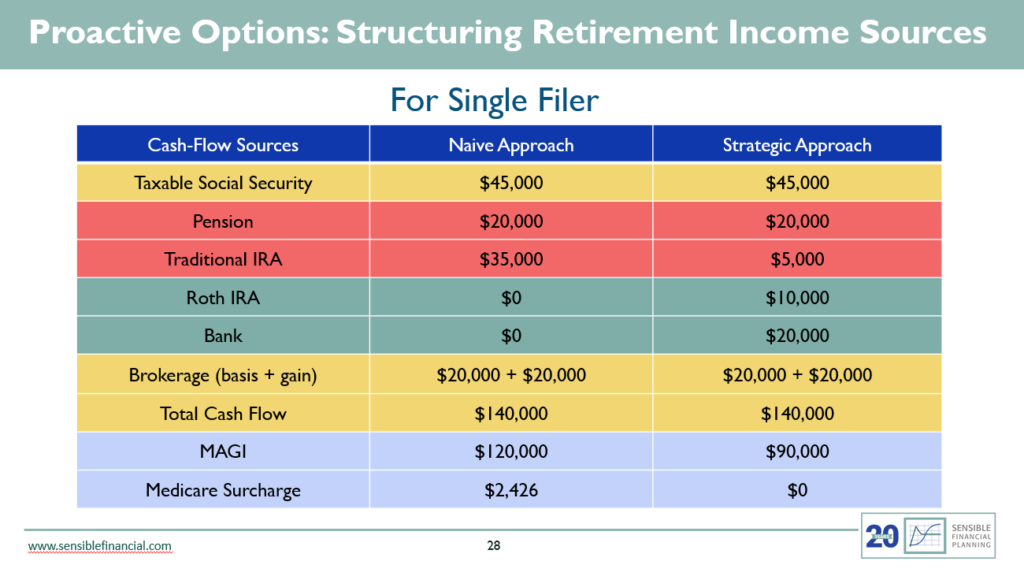

Let’s compare two approaches for structuring your retirement income to reduce IRMAA surcharges.

Each of these approaches has the same amount of cash flow, but the strategic approach has a MAGI of 90,000, right just below the limit of 91,000. This person avoided almost $2,500 in premium surcharges by just structuring their income differently and avoiding two tiers of IRMAA surcharges. This is one of the best opportunities many retirees have for keeping their MAGI down.

Early Roth conversions

A Roth conversion takes money out of an IRA and moves it into a Roth IRA. IRAs are pre-tax money; Roth IRAs are after-tax. Roth conversion is a taxable event which increases your MAGI for that year. Doing a Roth conversion more than two years before you start Medicare increases your MAGI when it doesn’t matter yet.

By doing this, you can reduce your future required minimum distributions by having more money in the Roth and less in your pre-tax accounts. You also give yourself flexibility, like in the strategic approach from the last section.

Making Roth conversions after you’ve started Medicare can still be helpful. Having a larger Roth balance can reduce your MAGI enough to avoid surcharges in multiple years. You can do a Roth conversion and pay a bigger surcharge only in the year for which it affects your MAGI. Doing so might allow you to then stay under the threshold in multiple future years by optimally structuring your income.

Investment modifications

There are four investment modifications you can make to reduce your MAGI.

- Asset location. Place tax inefficient assets in tax-deferred accounts. For example, hold a bond fund in an IRA instead of in a taxable brokerage account.

- Strategic capital gain and loss realization. If yourMAGI is creeping up toward the top of one of the thresholds at the end of the year, you could do some tax loss harvesting. That means selling some positions at a loss to wipe out gains you may have taken earlier in the year. You could also sell an appreciated property at least two years before starting Medicare. For example, if you plan to downsize to a smaller house, consider selling at age 62 or earlier, before you start Medicare.

- Low portfolio turnover. Investing in passive or index funds helps reduce the turnover of a portfolio. There are fewer trades, and you have more control over when the gains or losses are realized. High-turnover portfolios tend to generate gains and losses without as much control.

- Using Exchange Traded Funds (ETFs). ETFs are an investment vehicle like a mutual fund. They generally have fewer capital gain distributions than a mutual fund and are usually more tax efficient.

Tax deductible plan contributions

If you’re still working, increasing pre-tax retirement plan contributions can help you avoid taxation on the contributed amount.

For example, if you earn $100,000 a year as your only income source, contributing to a pre-tax 401k a year before retirement would let you reduce your MAGI below the $91,000 threshold and avoid an IRMAA surcharge.

HSA contributions also help reduce MAGI, but you can’t contribute to an HSA while you’re enrolled in Medicare.

The SSA-44 Life-Changing Event Form

I said earlier that the SSA calculates your MAGI based on the income on your tax report from two years ago. However, under special circumstances, you can have them calculate your MAGI based on your estimate for this year’s income. If any of these eight things happen to you, you can fill out the SSA-44 Life-Changing Event Form to see if you qualify.

- A marriage

- A divorce or annulment

- The death of a spouse

- A work stoppage or reduction

- Loss of an income-producing property

- Loss of pension income or employer settlement payment

- Retirement

Filing this form can be advantageous if your income was higher previously. Let’s say you stop working, so your income decreases. An accountant can help you complete the form, which asks for evidence of the event you’ve experienced and an estimate of your income for the current year. If the SSA accepts the form, they’ll use your estimated income for this year to calculate your MAGI.

Final considerations for minimizing Medicare surcharges

I hope you have a better grasp on what IRMAA surcharges are and that you find these strategies helpful for combating them. Remember, it’s important to plan conservatively. Even $1 of extra income can have a big effect on the surcharge you pay, if it pushes you into a higher bracket.

These strategies are simple in theory, but everyone’s situation is different, and implementing them effectively can be confusing and overwhelming. If you need help, schedule an appointment with one of Sensible Financial’s financial advisors.

Photo by Siora Photography on Unsplash