This is Part 2, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

This is Part 2, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

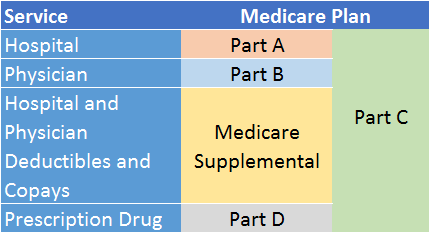

In last month’s newsletter, I gave a summary of Medicare, the Federal government insurance program that covers a large portion of health care expenses for seniors and people with certain disabilities. In that article, I said that Parts A and B form the core of Medicare, with other parts supplementing these two programs. In this article, I focus on Medicare Part A. Part A pays for health care services other than those provided by one’s personal physician, surgeon, or anesthetist.

What does Part A cover?

Part A covers nursing services, room charges, meals, diagnostic services, prescription drugs, and rehabilitation therapy administered by a hospital or skilled nursing facility (often a nursing home). It also covers home care services provided by a home health agency if considered necessary after a hospital stay. Finally, it covers most hospice services for those who are terminally ill with six months or less to live and have stopped all medical treatment in place of palliative care.

For Part A to cover a stay in a skilled nursing facility, you must have already been formally admitted to a hospital (i.e., not merely held for “observation”) and stayed for at least three days prior to your stay in the skilled nursing facility (known as the 3-day rule). It is important to note that Part A pays only for relatively short-term rehabilitation in a skilled nursing facility after leaving a hospital . Examples include intermittent skilled nursing care, as well as physical, speech, and occupational therapy. It does not pay for long-term care.

For Part A to cover a stay in a skilled nursing facility, you must have already been formally admitted to a hospital (i.e., not merely held for “observation”) and stayed for at least three days prior to your stay in the skilled nursing facility (known as the 3-day rule). It is important to note that Part A pays only for relatively short-term rehabilitation in a skilled nursing facility after leaving a hospital . Examples include intermittent skilled nursing care, as well as physical, speech, and occupational therapy. It does not pay for long-term care.

The rehabilitative services provided by a home health care agency are similar to those of a skilled nursing facility, but the services are provided in your home. To qualify for home health care coverage under Part A, you must be homebound and under a doctor’s plan of care. Only a Medicare-approved Home Health Care agency can provide these services.[1]

Who qualifies for Part A, and what does it cost?

To qualify for Medicare Part A, as with other parts of Medicare, you must be at least 65 years old or under 65 with a qualifying disability. (For brevity, I refer to this as the age of eligibility.) You must also be a U.S. citizen or permanent legal resident who has lived in the United States for at least 5 years. However, the 5-year rule is waived if you are a green card holder and have been married to a U.S. citizen or green card holder for at least 1 year, and your spouse is at least 62.

Perhaps you’ve heard that Part A is free. Whether you pay premiums for Part A coverage depends on your work history, or that of your spouse, ex-spouse, or late spouse if you have not accumulated a sufficient earnings record of your own. As you earn, you pay taxes into the Medicare system.[2] For every quarter you work and pay into Medicare, you earn a single “work credit”.[3] When you have earned forty work credits, you are eligible to receive Part A coverage premium-free when you reach the age of eligibility.

But what if you don’t have a sufficient earnings record when you become Medicare-eligible? If you are married, and your spouse has earned 40 work credits, then you will qualify for premium-free Part A. If your spouse died, and he or she had 40 work credits, you will also qualify. Divorced? If you were married for at least 10 years, haven’t remarried, and your ex is at least 62 and has 40 work credits, you can obtain Part A premium-free. Your ex-spouse has died? Not to worry: the same provision as above applies provided you didn’t remarry before 60 (or 50 if you have a qualifying disability).

You must pay Medicare Part A premiums only if neither you nor your spouse/ex-spouse/late spouse has earned 40 work credits. If there are fewer than 30 credits, you will need to pay the full cost of Part A if you enroll. In 2017, that will cost you $413 per month for life (ouch!). If either of you has between 30 and 39 credits, the premium is $227 per month. You cannot combine work credits between spouses. Fortunately, the vast majority of Americans will be able to obtain Medicare Part A free of premiums.

So, Part A really is free for most people?

Not exactly. First, even though there are no ongoing premiums for most people, the payroll taxes you pay prior to the age of eligibility are a type of pre-paid premium. Second, Part A also comes with deductibles and co-pays. The costs for each differ depending on whether you are admitted to a hospital or a skilled nursing facility, as well as the length of your stay in each. The following table from the Social Security Administration breaks down these costs:[4]

| Part A Deductibles and Co-pays | 2016 | 2017 |

|---|---|---|

| For first 60 days in a hospital, patient pays (deductible) | $1,288 (total for 60 days) | $1,316 (total for 60 days) |

| For 61st through 90th days in a hospital, patient pays (co-pay) | $322 per day | $329 per day |

| Beyond 90 days in a hospital, patient pays (for up to 60 more days) | $644 per day | $658 per day |

| For first 20 days in skilled nursing facility, patient pays | $0 | $0 |

| For 21st through 100th days in a skilled nursing facility, patient pays | $161 per day | $164.50 per day |

| Beyond 100 days in a skilled nursing facility, patient pays | All costs | All costs |

As you can see, Part A deductibles and co-pays increased by approximately 2% across the board between 2016 and 2017 to keep up with the increasing costs of health care. Future increases are likely, albeit uncertain. Medicare Supplemental (Medigap) insurance will cover most of these costs, but Medigap insurance is not free. [5], [6] I will discuss Medigap in a future article.

Are there any other hidden costs?

Of course there are. The above-mentioned costs apply to just one benefit period. A benefit period is defined as the number of days you must be out of the hospital or skilled nursing facility to qualify for a new benefit period. (Wait, what?)

For Part A, the benefit period is 60 days. If you leave a hospital or skilled nursing facility but re-enter within 60 days of your release, you enter under the current benefit period and do not have to pay the deductible again. If you re-enter beyond 60 days of your release, you enter a new benefit period, and you are subject to a new deductible and co-pay cycle. So, the timing of a re-admission can have a significant impact on your out-of-pocket costs (not that you have a choice if you are sick). There is no limit on the number of benefit periods to which you are entitled.

When and how do I enroll?

There is no late penalty for delaying enrollment in Part A. However, most people enroll in Part A when they turn 65 (or earlier with a qualifying disability), even if they delay enrolling in Part B. Also, if you are already receiving Social Security benefits, you will automatically be enrolled in Part A when you turn 65 (or earlier with a qualifying disability).

There is one exception where it might be advantageous to delay enrollment. If you can retain coverage under your employer health plan after you turn 65, and it is a high-deductible plan with a health savings account (HSA), delaying Part A until you retire will enable you to continue contributing to your HSA. In other words, Part A and HSA contributions are incompatible. However, you should carefully evaluate your employer plan for the quality of its hospitalization coverage before delaying your Part A enrollment.

You can enroll in Part A over the phone or by visiting your local Social Security Administration office. To make an appointment, call 1-800-772-1213. Alternatively, you can enroll online at www.ssa.gov. For any method you choose, it is important that you clearly state your intentions to enroll (or not) in Medicare Part B to avoid any unintended consequences.

I have not covered every Medicare Part A rule and exception in this article. If you are not sure if you qualify for Part A, or if you might have to pay a premium, you should consult your financial advisor.

In next month’s newsletter, I will discuss Medicare Part B, the Part that covers the cost of physician care.

Footnotes

[1]You can find a list of Medicare-approved home health care agencies here: https://data.medicare.gov/Home-Health-Compare/Home-Health-Care-Agencies/6jpm-sxkc/data

[2]As of 2017, employees pay 1.45% of wages with an additional 0.9% levied on wages in excess of $200k. https://www.irs.gov/taxtopics/tc751.html

[3]As of 2017, one work credit requires $1,300 of pre-tax earnings. https://www.ssa.gov/pubs/EN-05-10003.pdf

[4] https://www.ssa.gov/pubs/EN-05-10003.pdf

[5]Medicaid, the Federally funded, state-administered program for low-income individuals and families, will pay for most of Part A premiums, deductibles, and co-pays for those who qualify.

[6]Medicare Advantage plans (which serve as an alternative to traditional Medicare A and B, as well as Medigap) have different deductibles and co-pays for hospital and skilled nursing facility stays. These costs even vary widely among Medicare Advantage plans. I will cover Medicare Advantage in a future article.