In my last article, I covered the two sources of bond returns and how bonds are values. In this piece, I’ll focus on inflation and how it impacts bonds.

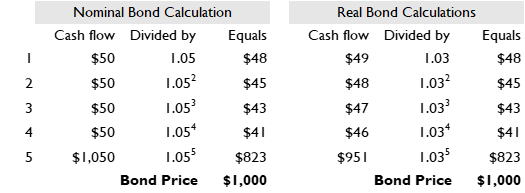

Built into our original bond return example was an inflation expectation. We used a “nominal” discount rate, or a rate not adjusted for inflation, to calculate our bond’s nominal or dollar price. We could also calculate the “real”, or adjusted-for-inflation, bond price with some minor adjustments.

Let’s assume that all investors believe that inflation will be 2% every year over the life of our bond. The “real” discount rate we would use to value our bond is 5% minus 2% inflation or 3%. To calculate our bond’s real price using a real interest rate, we must adjust future cash flows by inflation to get real cash flows. The left-hand table is our original bond calculation using all nominal numbers. On the right-hand table, I’ve converted future cash flows to real dollars (adjusted for inflation) and discounted them using a real discount rate.

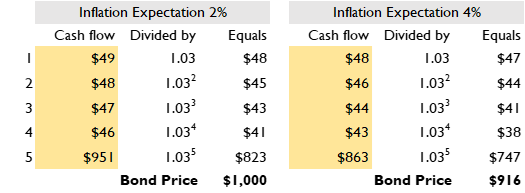

You will notice that both calculations lead to the same price. But what if inflation expectations change from 2% to 4% the day after you buy the above bond? Intuitively you know that the payments you receive over five years will be worth less than you anticipated. We can use bond valuation again to calculate the price effect.

When inflation expectations change from 2% to 4%, real cash flows decline. Bond coupons and the original face value are worth less in real dollars due to inflation. We discount these cash flows at 4% versus 2% to get our new expected real future cash flows. We recalculate the price of our bond after the increase in inflation as follows:

Discounting future real cash flows to the present we see that our bond is only worth $916 after inflation increases. That is a loss of almost 10%. Inflation reduces bond investors’ real future cash flows, but the effect is difficult to see as nominal cash flows are the same.

After inflation stabilizes to its new level, nominal interest rates will eventually adjust upward to 7%. A new bond issued in this situation would have $70 coupons, and would be priced at $1,000 (the discount rate would be 7% instead of 5%). The 3% real discount rate would be the same: 7% minus 4% inflation is the same as 5% minus 2% inflation.

Summary

Bonds are loans investors (lenders) make to issuers (borrowers). A bond’s total return is the sum of its income and capital, or price, return. The capital return can vary due to several factors, but when bond prices change due to changes in interest rates, it does not change the investors’ promised cash flows. Changes to bond prices due to credit changes or unanticipated inflation however can result in real losses.

In my next article, I will show how to manage these risks and how rising rates may make investors better off even after bond prices decline.

All written content is provided for information purposes only. Opinions expressed herein are solely those of Sensible Financial and Management, LLC, unless otherwise specifically cited. Material presented is believed to be from reliable sources, but no representations are made by our firm as to other parties’ informational accuracy or completeness. Information provided is not investment advice, a recommendation regarding the purchase or sale of a security or the implementation of a strategy or set of strategies. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.