At Sensible Financial we spend a lot of time thinking about and advising on Social Security. A search on our website yields over a dozen articles. For most Americans, Social Security is their largest asset. (If it is not your largest asset it is still likely to be a very large asset).

Choosing when you file for Social Security retirement benefits has a major impact on the amount you receive. You can file anytime between the ages of 62 and 70. Filing earlier means you’ll receive less sooner. Filing later increases your monthly benefits, but you’ll have to wait longer to get them. Traditionally, financial advisors have focused on the risk of outliving one’s assets as a reason to delay filing for as long as possible. In this article I will review that logic and identify some additional factors that may argue in favor of waiting.

Social Security rules are complex and everyone’s situation is different. That’s why we believe there is no substitute for a financial plan. The factors I outline here are not exhaustive and my conclusions should not be taken as recommendations for you. Rather, these are some of the major factors we’ve identified over the years that may favor delaying filing for Social Security. If you have any questions specific to your circumstances, contact your advisor. If you don’t have an advisor, consider getting a financial plan.

Before reviewing the reasons you might want to delay your Social Security retirement benefit, I will discuss retirement benefits and how your filing age affects them.

When you file matters.

Social Security retirement benefits are based on your Full Retirement Age (“FRA”). Your FRA is between ages 66 and 67 and depends on the year you were born. Your FRA benefit is the retirement benefit you would be entitled to if you filed at your FRA.

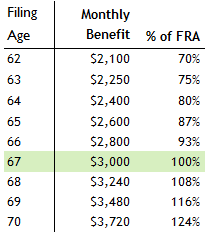

File prior to FRA and your benefit will be lower than your FRA amount. File after and it will be higher. In the table below I’ve illustrated different benefits based on filing age for someone with an FRA of 67 and an FRA monthly benefit of $3,000.

At the extremes this person’s benefit as a percentage of their FRA benefit could be reduced by as much as 30% if they file at 62 and increased by as much as 24% if they file at 70. In general, living longer makes delaying your benefit more advantageous since you will receive larger benefit for a longer time.

Let’s turn our attention to several factors that tend to favor delaying Social Security retirement benefits.

You could live a long time.

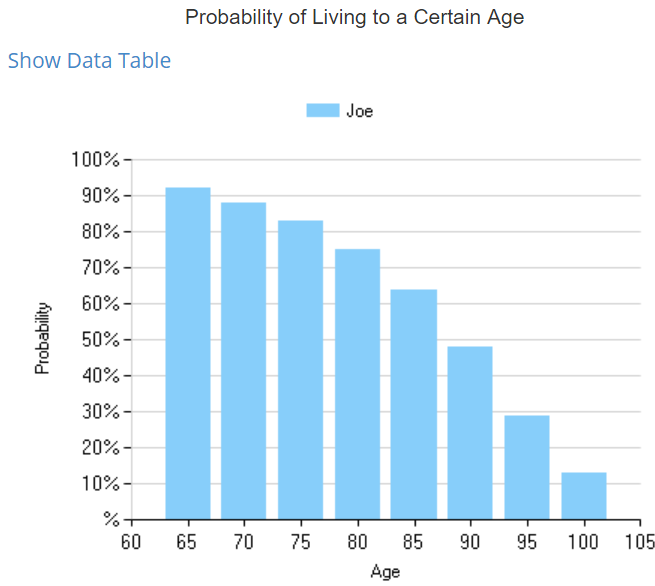

Perhaps you do not have longevity in your family. Perhaps you do, but you’re sure you won’t live a long time. Perhaps you just plain don’t trust actuaries (in which case skip to the next section). But if you care about the probabilities, I encourage you to visit www.longevityillustrator.org and fill out the short questionnaire to put longevity into perspective. I’ve done so for the chart below, which illustrates the probability that Joe, a hypothetical 40-year-old male in excellent health, lives to a certain age.

Joe has a 50% chance of living to age 90. He has a 30% chance of living to age 95(!). The probabilities for a comparable female are 60% (age 90) and 40% (age 95).

Now if a 30% chance of living to 95 does not convince you to delay filing for Social Security, think about the fact that Joe has a greater than 90% chance of living to age 65 – or less than a 10% chance of not living to 65. Let’s assume that Joe, like most Americans, buys life insurance when he is young to protect his family in case of premature death. He pays insurance premiums for 20 or 30 years to insure against the unlikely event he dies prior to turning 65. Why wouldn’t Joe protect himself from outliving his assets by delaying Social Security? Where life insurance protects your loved ones if you die prematurely, delaying Social Security protects you (and possibly your spouse) from outliving your assets if you live a long time. Think about it as reverse life insurance.

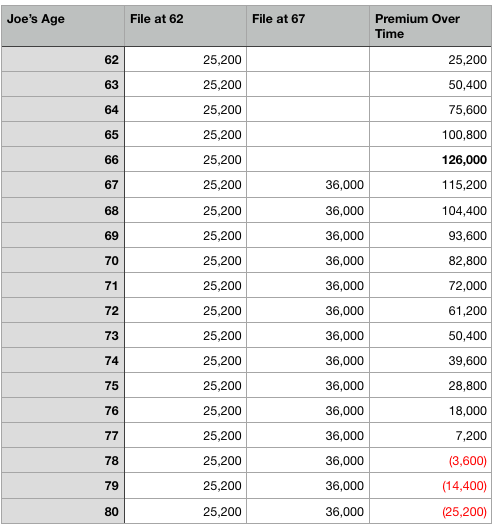

To continue the reverse life insurance example, imagine Joe waits to file until 67. The amount he gave up by not filing at 62 is $126,000 and can be thought of as an insurance premium (see table below). This $126,000 is the maximum he’ll “pay” assuming he dies when he turns 67. After 67, the premium decreases every year by $10,800, which is the additional Social Security benefit he receives from delaying filing. This means that if Joe lives to 78, he will not only get his premium back but also receive an extra $10,800 per year (or $900 per month) in inflation-adjusted dollars for the rest of his life.

Financial advisors generally think that delaying Social Security is a great deal. Consumers not so much, with about one in three Americans claiming their Social Security retirement benefit as early as possible. However, even if you are not convinced by the longevity argument, there are other factors that weigh in favor of delaying Social Security.

You are still working.

If you have not yet retired and your combined income and savings is large enough to cover current expenses, you should consider delaying Social Security. Intuitively, most people think about Social Security as a means of replacing at least some earnings. It follows that if you are currently working you may not need to file for Social Security retirement benefits. You don’t need the income yet.

There are at least three more reasons why filing while working may be suboptimal.

One, you are choosing to pay taxes earlier than necessary. Up to 85% of Social Security benefits are subject to federal income tax (if you live in one of these 13 states, you will also owe state income tax). There are not many things you can choose to defer paying taxes on, but Social Security is one of them. Similar to the tax deferral you receive from leaving money in an IRA, Social Security is not taxed until you start taking benefits. So, if you do not currently need the money, you can continue to benefit from tax deferral by waiting.

Two, if you file for Social Security retirement benefits prior to reaching Full Retirement Age (“FRA”) your benefit may be reduced by the Social Security earnings test. Social Security reduces benefits by $1 for every $2 in earned income above a certain amount ($17,640 in 2019). Although you will eventually get the money back, you will have to wait. If you don’t need the money (because you’re still working) and you wouldn’t receive some of the money now anyway (because you’re still working), consider delaying.

Three, if you are still working and don’t need Social Security to cover expenses, you will end up saving the benefits you receive. This begs the question: would you be better off investing your Social Security benefit or delaying and letting your benefit grow? I’ll cover this question below.

You have savings outside your retirement accounts.

Let’s assume you retire prior to age 70. You now must choose between taking Social Security benefits or spending down savings. How do you decide?

Unfortunately, there is no straightforward way to compare an increase in Social Security benefits to the expected increase in an investment account. The most relevant comparison is between Social Security and an inflation-adjusted commercial annuity (see my previous article here if interested). Nevertheless, if you want to try to compare Social Security to stocks and bonds, here are some factors that may help you decide between drawing down savings or filing for Social Security:

- The current rate of return. If the rate of return is low (as it is today in 2019) drawing down savings is more likely to be to your benefit because the expected return on your savings is low. The 8% annual increase in Social Security benefits is fixed.

- Your standard of living risk. If you are living at or above your means, what we at Sensible Financial call your “sustainable living standard”, you should delay Social Security if possible. Social Security is less risky than other types of investments and you have a lower ability to take risk the closer you are to living at your sustainable living standard.

- Other sources of guaranteed income. The more sources of guaranteed income you have in retirement in addition to Social Security, such as a pension or an annuity, the more flexibility you with respect to filing for benefits.

- Inflation. If you are particularly concerned about unanticipated inflation or a large portion of your spending is sensitive to inflation, delaying Social Security is an attractive option since delaying locks in higher lifetime inflation-adjusted income.

You are married and earned more than your spouse.

If you are married and you were the higher-earning spouse, delaying your retirement benefit is even more likely to benefit your family. This is due to Social Security Survivors Benefits.

There are Social Security considerations beyond retirement benefits. Social Security also provides survivor benefits to spouses (and sometimes children) in certain situations. When a Social Security beneficiary dies, that person’s surviving spouse is entitled to up to 100% of the beneficiary’s FRA benefit, if the beneficiary hadn’t yet claimed retirement benefits, or the beneficiary’s actual benefit, if that beneficiary was already receiving benefits. That last point is crucial. If you delay your benefit until 70 and predecease your spouse, he or she will receive that larger benefit for their entire life. This strategy is particularly important to protect a surviving spouse who perhaps stayed home to raise a family or had lower earnings.

Let’s return to the example of Joe, the extremely healthy 40-year-old. Let’s assume it is now 30 years in the future and Joe (sensibly) delayed his retirement benefit until his 70th birthday and receives $3,720 per month. Joe’s wife, Jane, who is also 70, receives $2,200 per month based on her earnings history. If Joe dies first, Jane will receive the higher of her or Joe’s benefit, or $3,720 per month, for the rest of her life. It’s as if by delaying Social Security Joe purchased not only protection against outliving assets for himself but life insurance to protect Jane. Importantly, had Joe filed for benefits as early as possible, at age 62, Jane’s maximum monthly benefit would be capped at $2,200.

In summary

Ultimately, how much you (or your survivors) receive from Social Security will depend on how long you live – something that is impossible to know beforehand. That said, there are many other reasons, such as those that I have outlined above, that argue for delaying Social Security. In a future article I’ll cover some of the situations where filing early may be the more sensible approach.