In my previous article, I describe how the Social Security program works and examine the program’s financial standing over the last thirty years. Currently, Social Security is running a small annual surplus, paying benefits as scheduled, and trust fund reserves are larger than they’ve been in decades. At a glance, everything appears A-ok.

However, the past is past. Given the magnitude of scheduled benefits and the nation’s aging population, the U.S. Treasury Secretary predicts that program expenditures will exceed receipts by 2022, and that Social Security trust fund reserves will begin to decline. If current projections hold, the trust fund will be depleted by 2034. From that point forward, payroll taxes will cover only about ¾ of scheduled benefits.

In this article, I outline the program’s long-run financial shortfall and the future tax increases or benefit reductions necessary to close the gap. I hope to provide you with insight into the future of Social Security, including how future changes to the program are likely to impact your financial plan.

How bad can it really be?

The Social Security trust fund[1] is essentially a savings account monitored by a Board of Trustees (“Trustees”).[2] When incoming tax receipts exceed outgoing benefit payments, the Trustees invest the excess funds in special U.S. Treasury bonds held in the trust fund for future periods. When tax receipts are less than benefit payments, the Trustees redeem bonds in the trust fund to cover the shortfall. If the trust fund is empty, tax receipts are the only source available to cover benefit payments.

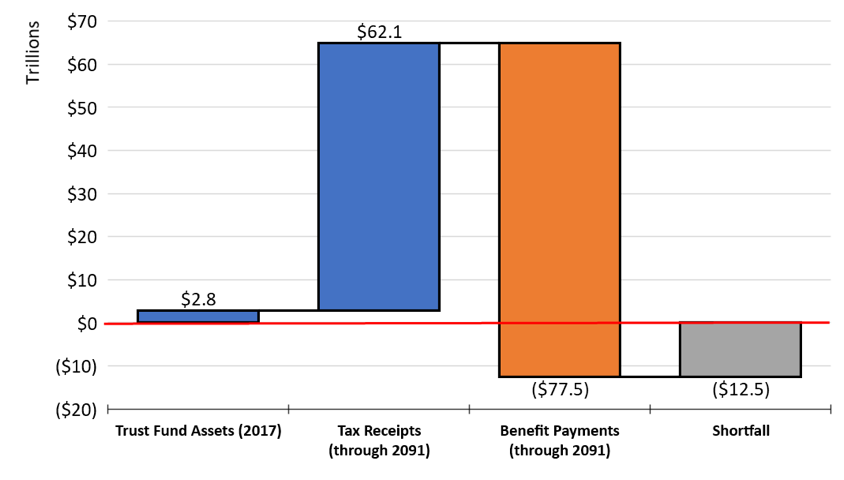

One of the Trustees’ key roles is to report to Congress each year on the financial status of the Social Security trust fund, both past and future.[3] In their Annual Report, the Trustees project the financial status of the trust fund over the next 75 years.[4] Essentially, the Trustees sum up the present value of future tax receipts, add them to the current balance of the trust fund and subtract the present value of future benefit payments. The remainder is an estimate of the financial shortfall (if negative) or surplus (if positive) of the trust fund over that period. As seen in the chart below, in 2017, the Trustees estimate the present value of the shortfall over the next 75 years to be $12.5 trillion. In other words, the Social Security trust fund would need to borrow $12.5 trillion today to pay all scheduled benefits in a timely manner over the next 75 years.[5] According to the Trustees, this amounts to 2.7% of future taxable payroll (i.e., the total base of U.S. wages subject to Social Security payroll taxes) and 0.9% of GDP over that time.[6]

Figure 1. Under current law, Social Security is projected to be $12.5 trillion short over the next 75 years

Fixing Social Security means increasing taxes, reducing benefits, or both

The Trustees’ Annual Report provides a solid basis for projecting what is necessary to make the Social Security program financially solvent. Social Security reform is likely to encompass a variety of programmatic changes, such as modifications to the benefits formula, payroll taxes, and the retirement age. However, any reform will boil down to an increase in program revenue and a decrease in program expenditures. This means some combination of tax increases and benefit cuts.

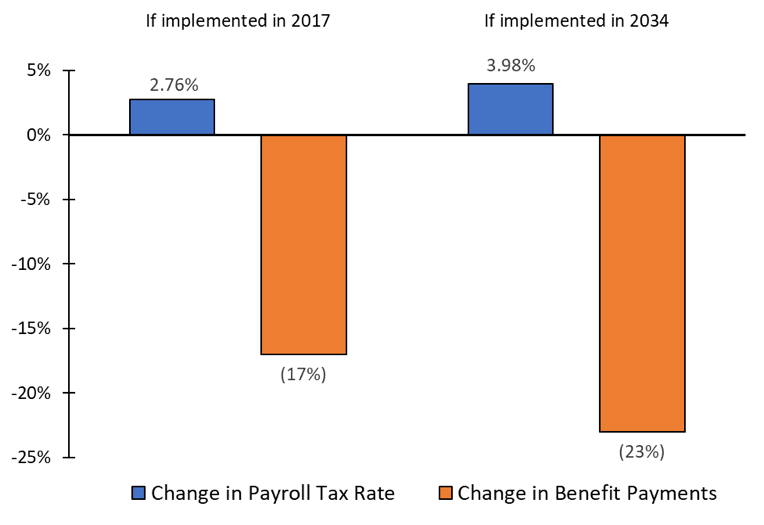

The figure below shows the increase in payroll taxes or reduction in benefits that the Trustees estimate is required to close the program’s $12.5 trillion financial shortfall over the next 75 years. The leftmost bars show the required changes if the policies are implemented immediately (2017), and the rightmost bars show the required changes if the policies are implemented in the predicted year of trust fund depletion (2034). The longer Congress delays implementing reform, the larger the increase in payroll taxes or reduction in benefits required to close the shortfall.

Figure 2. The longer Congress delays implementing reform, the greater the increase in payroll taxes OR reduction in benefits required to close the 75-year financial shortfall.

As the figure above shows, for effective action this year, the Trustees estimate that

- The Social Security payroll tax rate would have to increase immediately and permanently by 2.76 percentage points (from its current rate of 12.40% to 15.16%),[7]

- Scheduled benefits would have to decrease immediately and permanently by 17% for all current and future beneficiaries, or

- Some combination of these approaches.

However, given Congress’ lack of focus on the issue, it’s highly unlikely reform will occur soon. If nothing is done until 2034 (the predicted year of trust fund depletion), the magnitude of required changes will be significantly greater as the changes will concentrate on fewer years and fewer generations.

For Social Security to remain solvent over the next 75 years with policies that begin in 2034, the Trustees estimate that the payroll tax rate would require a permanent increase of 3.98 percentage points (from its current rate of 12.40% to 16.38%), scheduled benefits would require a permanent decrease of 23%, or some combination of these approaches.

Conclusion

It’s no secret that Social Security requires major reform. By 2022 the program is predicted to be cashflow negative and by 2034 unable to fully cover its financial obligations. To pay all scheduled benefits on a timely basis over the next 75 years, the Social Security trust fund would need to borrow $12.5 trillion today. To cover this shortfall, Social Security will need to implement some combination of tax increases and benefit cuts prior to the depletion of the trust fund. The longer Congress delays, the larger the tax increase and/or benefit cuts necessary to close the gap.

Social Security is an important component of your financial plan, no matter your age or earnings history. Having a realistic estimate of the amount you will pay in Social Security taxes and the amount of guaranteed income you expect to receive from Social Security in retirement is critical to your plan.[8] In my next article, I will examine how future changes to Social Security are likely to impact you and your financial plan, and discuss how Sensible Financial accounts for these changes in its recommendations.

[1] Technically speaking, there are two Social Security trust funds. One pays retirement and survivor benefits (the Old-Age and Survivor trust fund), and the other pays disability benefits (the Disability Insurance trust fund). Although they are separate legal entities, Congress has in the past allocated reserves from one fund to shore up the financial solvency of the other. Therefore, as a practical matter, it makes sense to look at the combined balance of the trust funds.

[2] The Trustees include the Secretaries of Treasury, Labor, and Health and Human Services, and the Commissioner of the Social Security Administration.

[3] The Trustees also monitor, and report on, the Medicare (or hospital insurance) trust fund, which operates in a similar fashion to that of the Social Security trust funds. The Medicare trust fund generates revenues via payroll taxes and funds Medicare Part A for retirees.

[4] See the 2016 and 2017 reports: www.ssa.gov/OACT/TR/2016/tr2016.pdf; www.ssa.gov/oact/tr/2017/tr2017.pdf.

[5] Current law does not permit the trust funds to borrow money to pay benefits.

[6] Estimating the program’s shortfall over a certain number of years (e.g., 25, 50, or 75 years) is entirely arbitrary. Program expenditures are projected to be greater than revenues for the foreseeable future. This means the longer the analysis period, the greater the shortfall. In fact, the Trustees estimate that it would take $34.2 trillion dollars (nearly three times the magnitude of the 75-year shortfall) to make the program financially solvent indefinitely. This amounts to 4.2% of future taxable payroll and 1.4% of GDP.

[7] The Social Security Administration currently levies a 6.2% payroll tax on wages paid for employees and employers, each, up to an annually adjusted wage base of $127,200 as of 2017. Self-employed individuals pay the entire 12.4% of the tax.

[8] For example, how much you need to save for retirement and how much risk you can afford to take in your portfolio will all depend on how much you expect to receive from Social Security.

To speak with an advisor about planning for your financial future, contact us!