In my previous articles on Continuing Care Retirement Communities (CCRCs), I described the amenities these communities offer, what it’s like to live in one, the various types of contracts, and explained the difference between affordability and eligibility. In this article, I will give a concrete example of the latter.

Introducing Martha, a CCRC applicant

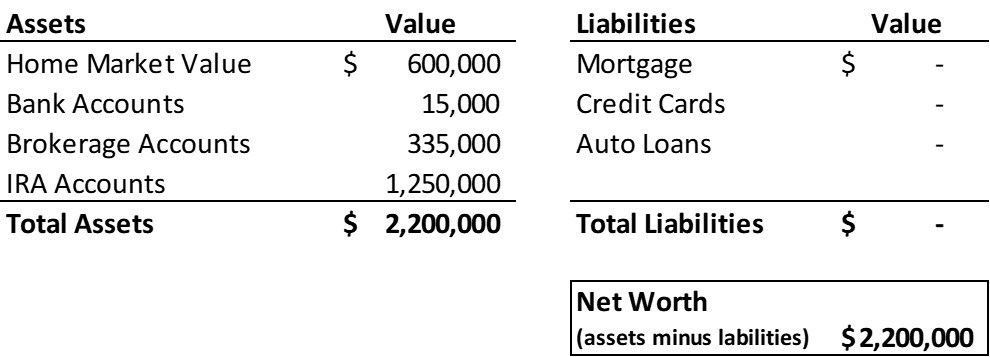

Here is an example of a situation we see often. Martha is an 82-year-old widow considering the additional support, security, and social engagement of CCRC living. The chart below illustrates her net worth.

After touring a local CCRC and speaking with the marketing representative, Martha has her eyes on a one-bedroom unit with a small den. This unit also includes

- A living room

- A fully equipped kitchen

- A bathroom with walk-in shower

- A stacked washer/dryer unit

- Plenty of closet space

Martha’s future housing unit will provide her ample private living space and will be a bright and sunny home. This unit has a waiting list of around two years.

Martha intends to buy a Type A, or “Life Care” contract. The entry and monthly service fees are more expensive than with a Type B or C contract, but it is more robust; with a Type A contract, the CCRC community is accepting more of the long-term care expense risk. Type A appeals to Martha because she doesn’t have her own long-term care insurance policy, and her mother and grandmother both lived long lives and spent some time in assisted living.

The one-time entry fee for this unit is projected to be approximately $550,000 in a couple of years, based on the CCRC’s historical average annual entry fee increase rate of 3.5%.[i] When she sells her current home, Martha will be able to purchase this unit with the proceeds and have a little left over for moving expenses.[ii]

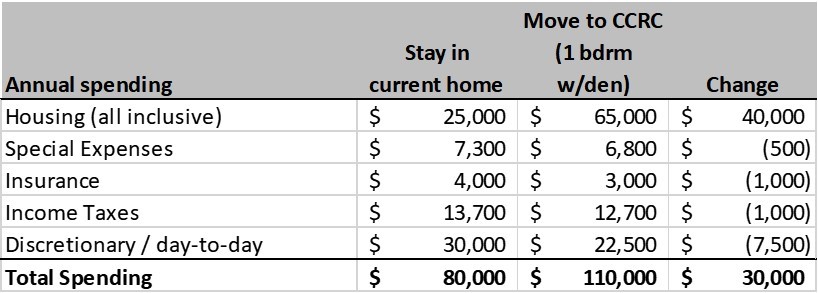

It’s important to consider Martha’s annual spending budget, and her sources of cash. Of course, Martha’s spending budget will differ based on the kind of housing she chooses—her current home or the CCRC. This chart compares both scenarios.

The monthly service fee for the unit Martha wants to purchase is projected to be $5,417 per month, or $65,000 per year, when she moves in (again based on historical rates of increase). This is a $40,000 per-year increase in housing costs compared to her current living situation. Martha will probably pay a little less in taxes each year because she can deduct part of the monthly service fee as a health care expense (subject to the medical deduction threshold). More importantly, her discretionary/day-to-day expenses will decrease because the CCRC monthly service fee includes the following:

- One chef-prepared meal per day while living independently in the CCRC

- Access to an on-site gym and pool

- On-site entertainment and social events

- Local transportation shuttle service for shopping, medical appointments, and entertainment, resulting in lower car expenses. Martha also plans to give up driving and sell her car when she moves to the CCRC. That will shave an additional $3,000 off her discretionary spending budget.

With the above items built into the service fee, we estimate Martha’s annual discretionary spending budget will decrease by 25% from $30,000 to $22,500 if she moves to the CCRC.

Even with the discretionary spending and income tax offsets, Martha’s total annual outlay will increase by approximately $30,000 if she moves to a CCRC. Martha understands that the peace of mind she seeks by moving to a CCRC will not come cheap. The Type A contract is basically a form of long-term care insurance, along with lifetime membership in a “turn-key” supportive and enriching social community. She won’t have to worry about whether (or where) she will receive the care she needs. She will have a guaranteed place in the community, regardless of her long-term health prospects. As far as Martha is concerned, these amenities are worth the additional cost.

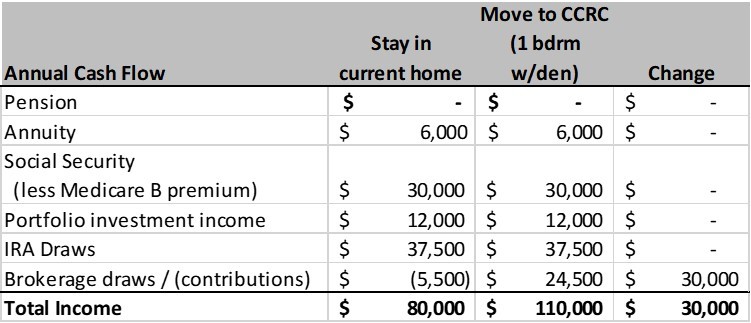

So, where will the money come from to pay all these expenses? Will Martha’s access to cash support the $110,000 in total annual spending necessary for her to move to a CCRC?

Martha doesn’t have a company pension, but she did purchase an inflation-adjusted annuity a few years ago, which currently pays her $500 per month, or $6,000 per year. She also receives $30,000 in inflation-adjusted Social Security survivor benefits (benefits on her late husband’s earnings record). In addition, she draws approximately $37,500 per year from her IRA. Finally, we project conservatively that her $1.6 million portfolio will, on average, generate approximately $12,000 per year in investment income over her lifetime. This adds up to $80,000 per year, which would support her “live-at-home” expenses. In fact, some of the income her portfolio generates could remain invested in the portfolio rather than be used for spending, as shown above (represented as a “net contribution” of $5,500).

If Martha decides to go the CCRC route, she would need to withdraw an additional $24,500 per year from her brokerage account to satisfy the $110,000 spending requirement.[iii] Combining this with her IRA distributions and her investment income usage implies a 4.6% annual portfolio withdrawal rate, which should be sustainable at her age.

CCRCs have the last word on eligibility

Our analysis of Martha’s finances suggests that she can afford the type of CCRC residence she desires. However, it is important to distinguish between affordability and eligibility. Financial advisors may determine something is affordable, but only the CCRC can make the final call on eligibility (after making its own evaluation of an applicant’s finances and health). They have their own proprietary financial models, which may differ from a financial advisor’s. And they aren’t always forthcoming with this information.

They do, however, publish general guidelines around assets and income. The CCRC Martha set her sights on recommends that applicants have at least 1.75 times the one-time entry fee in assets, and at least 1.75 times the monthly service fee in income, at the time their finances are evaluated for admission.[iv] Does she meet the CCRC’s guidelines?

Assets: The entry fee for the unit Martha wants is projected to be $550,000 in two years, around the time Martha’s name is expected to rise to the top of the waiting list. Excluding this amount, Martha currently has assets of $1.65 million, which is comfortably larger than the required 1.75 multiple. It’s 3 times larger. Assuming Martha doesn’t take on excessive investment risk or spend her money frivolously, she shouldn’t have difficulty meeting the 1.75 multiple for assets.

Income: The monthly service fee is projected to be $5,417 in two years. Martha will need at least 1.75 times the monthly service fee, or $9,480, in monthly income to qualify. This translates to approximately $114,000 per year in income. Although portfolio draws are not strictly speaking “income”, we already estimated that Martha’s various sources of cash generate $110,000. Some of these sources (the annuity and Social Security income) are inflation-adjusted, which strengthens her case for eligibility.

We don’t know the CCRC’s underlying financial assumptions regarding acceptable portfolio draw rates and future inflation. We also don’t know what life span assumptions they make for an 82-year-old woman (we assumed age 100 in our analysis). Nevertheless, because our analysis indicated that her financial resources would likely sustain her throughout her life, we would encourage Martha to complete the CCRC’s financial assessment worksheet and talk to the marketing representative about joining their waiting list. Even if the CCRC didn’t deem her eligible for a one-bedroom-with-den, she would almost certainly qualify for a one-bedroom (without den).

If you are interested in exploring whether a CCRC is right for you, and whether you can afford it, Sensible Financial can assist you in making that determination.

The CCRC qualification process is a two-way street. In my next article on CCRCs, I will discuss how to determine if a CCRC is worthy of having you as a resident.

[i] 3.5% nominal, or 1.5% above inflation, where inflation rate is assumed to be 2%.

[ii] 90% of the entry fee will be returned to her estate once she passes, but this is not relevant to our analysis because we assume the money would not be available to her while she is living at the CCRC.

[iii] If the brokerage assets become depleted at some point, she can substitute additional IRA draws.

[iv] The “multiple” requirements vary from one CCRC to another. This is just one example.