In a recent article, I wrote about how clients are responding to sustainable investing at Sensible Financial. In this article, I will discuss the broad array of approaches to sustainable investing, and how Sensible Financial is approaching it.

Sustainable investing has grown very rapidly in recent years, and now accounts for an estimated $17 trillion[1] in assets under management. Owners of these assets include large institutions like pension funds and endowments, as well as individuals and families investing through mutual funds and exchange traded funds (ETFs). Since 1995, these assets have grown more than 25-fold.

“Sustainable investing” and “ESG investing” are often (but not always) used interchangeably. ESG stands for “Environmental, Social and Governance”, and reflects a style of investing in which these factors are incorporated into investment decisions in some way. Like many rapidly growing industries, there are a variety of approaches utilized, as providers experiment with different ways of doing things.

Approaches to ESG investing can be grouped into three broad categories, as follows:

- ESG Screening or Values-Based Investing, in which companies and industries are screened out (or their weighting in a fund is reduced) due to involvement in activities contrary to the fund’s environmental, social, or governance criteria. These types of funds would screen out entire industries such as weapons manufacturing, adult entertainment, and coal production, as well as companies with, for instance, poor records for board diversity or executive pay practices.

- ESG Integration, in which environmental, social, and governance factors complement more traditional investment analysis. These factors are considered risks and companies are rated on how well they are managing these risks, relative to peers in their industry. Counterintuitively, funds of this type may include investments in certain controversial industries, such as those mentioned above. That is because participating in problematic industries is not a cause for being screened out; rather, it is the companies that are managing the risks of those industries most poorly that are screened out.

- Impact Investing, in which investments are made in companies that are “doing good” in some measurable way on environmental, social, or governance dimensions. Examples of this would be funds that invest disproportionately in solar energy companies or companies that are minority owned.

Across all three categories, there is much disagreement about what constitutes E, S, and G. For instance, are alcohol companies excluded? Are all fossil fuel producers excluded, or just those producing the dirtiest forms of energy such as coal or tar sands oil? Are all weapons manufacturers excluded or just those producing the most controversial weapons such as landmines or cluster munitions? Even a casual review of industry discussion and offerings reveals that there is no agreed standard on E, S or G.

Many of our clients are very interested in these ESG topics but are also interested in investment philosophy and results. Our investment philosophy emphasizes time-tested and research-backed investment principles including:

- Diversification

- Low cost

- Passive investment strategies

- Tax efficiency

Another factor that we consider when selecting mutual funds and ETFs is size of the fund or ETF. Larger funds have the possibility of lower costs, since they can spread their fixed costs over a larger investment base. In addition, larger ETFs generally trade more efficiently, especially in periods of market turmoil. Lastly, large funds are likely to be profitable for their sponsor (the mutual fund company), meaning they are less likely to be closed. Sometimes, a fund that does not reach critical mass is closed or merged with another fund, and that can cause problems for its shareholders. We avoid small funds where that is a distinct possibility. In the ESG space, there are many small funds as various providers enter the market and try to cater to differing investor preferences.

The Sensible Approach

For reasons of efficiency and error-prevention, we decided to select one approach to sustainability. In other words, even though among our client base there could be different preferences about the issues that people care about, or the style of ESG investing they prefer, we chose an approach that would appeal broadly to our clients, rather than having multiple approaches.

We also had to incorporate the investment philosophies and characteristics mentioned earlier. Because ESG approaches to investing are still somewhat new and the market is fragmented, there are relatively few ESG funds that pass our investment screening process — many are too small. That limited our options.

It turns out that the company that manages three of the funds that we use in our “standard” factor tilt portfolios (Dimensional Funds) is a leader in sustainable investing and has sustainable versions of three funds that we have been using for several years. These funds are all large enough and they use the same investment approach as in their standard funds. So, they are a good fit from an investment perspective. We also use a fossil fuel free ETF from State Street, a leading provider of index funds. These funds are examples of the ESG Screening approach mentioned above, though the Dimensional funds also have aspects of ESG integration in their approach.

These funds’ primary ESG screen is related to climate change, and specifically, greenhouse gas emissions. This is an issue about which many of our clients feel strongly, so we are glad to offer this option to them. In addition, the funds from Dimensional also incorporate screens related to six other issues: palm oil, factory farming, child labor, tobacco, landmines and cluster munitions, and civilian firearms. Companies manufacturing these products or employing these practices are generally excluded from the funds.

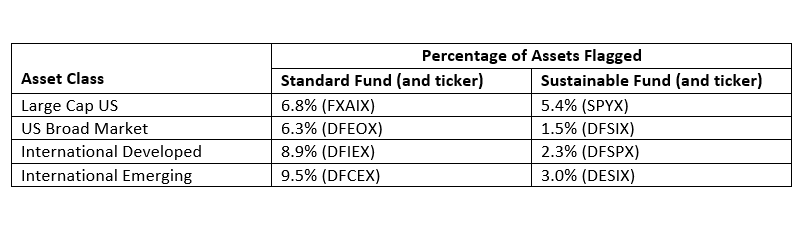

Though Sensible Financial does not have its own deep expertise in ESG screening, we do appreciate the metrics-based approach that is taken with these funds to emphasize companies with more favorable greenhouse gas profiles. Though the results are not perfect, data from the website fossilfreefunds.org (see table below) shows that the percentage of fund assets invested in companies with fossil fuel production, transmission, and reserves is significantly lower in the sustainable funds we have chosen than for their “standard” counterparts.

Comparing the investment performance of the various approaches to sustainable investing is beyond the scope of this article, but in the aggregate, evidence that ESG approaches systematically underperform or outperform their non-sustainable counterparts in inconclusive. Of course, past performance is not indicative of future results.

Over time, as interest in ESG considerations continues to grow and more investment options become available, we hope to have additional options to choose from. Specifically, we hope to soon offer sustainable versions of our market capitalization (index) portfolios to complement the current factor tilt sustainable portfolios. This will offer our clients more choices in expressing their values through their investing activity.

ESG or sustainable investing does not appeal to everyone, but for our clients who do wish to express their values in this way, we offer a sensible solution that accomplishes certain ESG objectives and is also sound from an investment perspective.

As always, if you are interested in discussing your portfolio, please contact your Sensible Financial advisor.

[1] US SIF: The Forum for Sustainable and Responsible Investment