This is Part 5, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

Welcome back to Sesame Street (for seniors). Today, we are going to talk about the letter “D”. (Sorry, but I couldn’t resist).

Medicare Part D covers outpatient prescription drugs. You can obtain Part D coverage through stand-alone drug plans or Medicare Advantage plans that include drug coverage as part of their benefits package. (Medicare Advantage is the subject of a future article.)

The “D” in the name presumably stands for Drugs, but it might as well stand for Doughnut because Part D is infamous for its “doughnut hole” pricing structure – the pricing phase that requires you to pay a higher share of your medication costs until you reach a certain out-of-pocket dollar amount. More on that later.

Scope of drug coverage under Part D

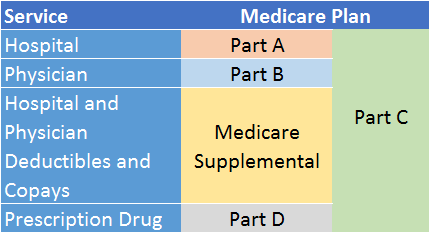

As I mentioned in an earlier Medicare article, Part D isn’t the only Medicare drug benefit. Part A (hospital coverage) covers drugs administered when you are a patient in a hospital or a skilled nursing facility (short-term stay, such as post-surgery rehab). Part B (doctor coverage) covers drugs administered in a doctor’s office, hospital outpatient departments, and in some circumstances, by hospice professionals.

Part D covers outpatient prescription drugs that you administer to yourself, a caregiver administers to you at your home, or you receive if you live in a nursing home.

Some drugs are not covered by any part of Medicare, such as over-the-counter or cosmetic-related medications, and drugs related to promoting fertility and treating sexual disorders.

Who should enroll, and when

To qualify for Part D, you must be at least age 65 (or younger with a qualifying disability) and enrolled in Medicare Part A or Part B (or both), or in a Medicare Advantage plan that does not include prescription drug coverage.1

If you have opted for traditional Medicare (Parts A and B) and do not have drug coverage as part of a former employer retiree health plan, then you will most likely want to enroll in Medicare Part D.

Part D is voluntary, but if you intend to enroll, you should do so at the time you enroll in Medicare Part A or Part B, or Medicare Advantage if it doesn’t include prescription drug coverage.

If you are late to enroll in Part D, you will be penalized in two ways: First, your premium will be higher for life; and second, you will have to wait until the Fall open enrollment period (October 15 to December 7) . Although the latter may seem like a mere inconvenience, it could be financially burdensome should you unexpectedly need expensive drugs for a serious illness and find yourself without coverage.

How Part D works – drug tiers and formularies

Many insurance companies offer Medicare-sponsored prescription drug plans. Each plan must adhere to Federally mandated Part D guidelines. For example, all plans must cover at least two drugs in each drug class. A class is defined as all the similar drugs that are used to treat the same medical condition. In some classes, drug plans must cover all drugs in that class. Anticancer, anticonvulsants, antidepressants, HIV/AIDS, and immunosuppressants are some examples.

However, plans differ in the specific drugs they cover, out-of-pocket costs, and certain other provisions and restrictions.

Central to each Part D drug plan is its Formulary, a list of prescription drugs that the plan will cover. Each plan sets its own formulary. The formulary divides the plan’s covered medications into four tiers, as follows:2

- Tier 1: This tier has the lowest co-pays because it includes the least expensive drugs. Generics are found here. Some Part D plans do not charge co-pays for generic drugs in this tier.

- Tier 2: This tier has a medium-priced co-pay because it covers the plan’s preferred brand-name drugs. The plan prefers that you use these drugs because it pays less for them after having negotiated discounts with the manufacturers.

- Tier 3: This tier has a higher-priced co-pay because it covers non-preferred brand-name drugs. The plan prefers that you not use these drugs because they’re expensive, or perhaps because the plan hasn’t managed to negotiate adequate discounts for them.

- Tier 4: This tier has the highest co-pays because it includes very expensive or specialty drugs, such as anti-rejection drugs used after organ transplant surgery, and drugs used to treat certain cancers. In many cases, you must pay a percentage (rather than a dollar co-pay) of the total cost for drugs in this tier.3

Drug plans change their formularies often, sometimes more than once per year. They will move a drug from one tier to another, or remove a drug from the formulary altogether. If your plan moves a drug you take to a more expensive tier mid-year, or removes it from the formulary for non-safety-related reasons, you have the right to keep taking the medication and paying your current co-pay for the rest of the calendar year.

It is very important to check your plan’s formulary at least once, preferably twice per year, to ensure that your medications are still covered, and that the co-pays are still affordable. If they are not, you may need to consult with your doctor about alternative medications, or change to a more suitable prescription drug plan during open enrollment.

Determining your out-of-pocket costs

Part D out-of-pocket costs consist of a monthly premium, a yearly deductible, and co-pays / co-insurance. The premium varies by the prescription drug plan you choose, as well as your income. The higher your income, the higher your premium. Within a given drug plan, the amount of your co-pays and co-insurance varies by the medication you take.

The chart below illustrates how your 2017 monthly premium would be calculated based on your income as reported on your 2015 IRS tax return (income 2 years’ prior). If your income is above a certain limit, you’ll pay an Income-Related Monthly Adjustment Amount (IRMAA) in addition to your plan premium, as shown below:4

Your total monthly premium in 2017 depends on your tax filing status and yearly income in 2015 |

|||

|---|---|---|---|

| File individual tax return | File joint tax return | File married & separate tax return | Total monthly premium (2017) |

| $85,000 or less | $170,000 or less | $85,000 or less | your plan premium |

| above $85,000 up to $107,000 | above $170,000 up to $214,000 | not applicable | $13.30 + your plan premium |

| above $107,000 up to $160,000 | above $214,000 up to $320,000 | not applicable | $34.20 + your plan premium |

| above $160,000 up to $214,000 | above $320,000 up to $428,000 | above $85,000 up to $129,000 | $55.20 + your plan premium |

| above $214,000 | above $428,000 | above $129,000 | $76.20 + your plan premium |

Your prescription drug plan’s other out-of-pocket costs divide into four phases:

- Phase 1: This phase is the plan’s deductible, which starts January 1 of each year. Until you meet the deductible, you must pay the entire cost of the drugs you buy. The standard deductible in 2017 is $400. However, some plans do not charge a deductible, and some charge less than the standard.

- Phase 2: This phase is called the Initial Coverage Period. It begins when you have met your plan’s deductible. You then pay the co-pays or co-insurance required by your plan for each prescription you take, and the plan pays the rest, up to an Initial Coverage Limit (ICL). This phase ends when the total cost of your drugs – what you’ve paid plus what the plan paid – reaches that limit. In 2017, the ICL is $3,700. The ICL increases slightly each year

- Phase 3: This phase is formally called the Coverage Gap. However, you might know it as the infamous doughnut hole. In this phase, you pay a higher amount out-of-pocket than in phase 2. This phase begins when you have reached the ICL of Phase 2, and it ends when the amount you have spent (from the beginning of the calendar year) reaches another dollar limit. In 2017, that dollar limit is $4,950. This limit also increases slightly each year.

Until 2011, Medicare beneficiaries were responsible for paying 100% of their drug costs between the ICL and the Coverage Gap limit (the doughnut hole, basically). However, over the years, this percentage has declined, thanks to the Affordable Care Act (Obamacare). By 2020, plan participants will be responsible for only 25% of the costs of their medications in this phase.

It is important to note that in phase 3, you receive credit toward the dollar limit for the full retail price of a drug even if the drug manufacturer is offering discounts on your purchase. This helps you escape the doughnut hole faster.

- Phase 4: If you are unlucky enough to reach phase 4 (i.e., your costs exceeded the coverage gap limit of phase 3), your share of any additional out-of-pocket costs drops dramatically to around 5%. This lasts through the end of the calendar year, at which point you go back to phase 1 on January 1 (or phase 2 if your plan has no deductibles).

Trying to understand tiers, phases, and constant changes to formularies, is enough to give anyone a headache. (Unfortunately, Medicare does not cover aspirin!)

In my next article, I will walk you through the process of choosing a Medicare Part D prescription drug plan (although I won’t be able to recommend which plan you should choose – the best plan for you will depend on many factors unique to you). Until then, go easy on the doughnuts!

Footnotes

1 Most Medicare Advantage plans now include prescription drug coverage as part of their benefits package.

2 Medicare for Dummies, by Patricia Barry, AARP, page 306.

3 Prescription drug plans can divide their covered drugs into fewer or more tiers if they want.

4 https://www.medicare.gov/part-d/costs/premiums/drug-plan-premiums.html

Rick Fine is a Senior Financial Advisor and CERTIFIED FINANCIAL PLANNERTM at Sensible Financial. Got a question for Rick about Medicare Part D? Ask in the comments section below. To speak with someone from our dedicated team about how we can help you plan for your financial future, click here!