This is Part 3, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

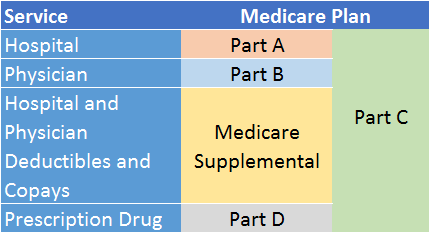

In this article, I discuss Medicare Part B – sometimes referred to as retiree “Medical Insurance”. Part B purportedly focuses on the services, diagnostic tests, and medical equipment that doctors provide or prescribe, as opposed to those services that hospitals and skilled nursing facilities provide (i.e., Part A, or “Hospital Insurance” – described in last month’s article). However, as you will see, there isn’t as clean a delineation between doctor and hospital services as the nicknames might suggest. In fact, it is not always intuitive why one set of services lands in the Part A vs. Part B column, and vice versa.

In this article, I discuss Medicare Part B – sometimes referred to as retiree “Medical Insurance”. Part B purportedly focuses on the services, diagnostic tests, and medical equipment that doctors provide or prescribe, as opposed to those services that hospitals and skilled nursing facilities provide (i.e., Part A, or “Hospital Insurance” – described in last month’s article). However, as you will see, there isn’t as clean a delineation between doctor and hospital services as the nicknames might suggest. In fact, it is not always intuitive why one set of services lands in the Part A vs. Part B column, and vice versa.

You can receive Medicare Part B benefits starting at age 65 if you are a U.S. citizen or legal resident (green card holder), you have lived in the United States for at least five years, you are enrolled in Part B, and you are paying (or the state is paying on your behalf if you qualify) Part B premiums.

What it covers

Medicare Part B covers the following services:1

- Approved medical services from any doctor anywhere in the nation who accepts Medicare patients, whether those services are provided in a doctor’s office, hospital, long-term care facility, or at home

- Diagnostic and lab tests done outside hospitals and nursing facilities

- Preventive care

- Some medical equipment and supplies, such as wheelchairs, walkers, oxygen, diabetic supplies, and units of blood

- Some outpatient hospital treatment received in an emergency room, clinic, or ambulatory surgical unit

- Some inpatient care in cases where patients are placed under observation in the hospital instead of being formally admitted

- Inpatient prescription drugs given in a hospital or doctor’s office, usually by injection (such as chemotherapy drugs for cancer)

- Some coverage for physical, occupational, and speech therapies

- Outpatient mental health care

- Approved home health services not covered by Part A

- Ambulance or air rescue service in circumstances where any other kind of transportation would endanger the patient’s health

- Free counseling to help curb obesity, smoking, or alcohol abuse

The above list of covered services doesn’t apply uniformly in all parts of the country. If you are unsure whether Medicare Part B covers a specific medical service or diagnostic test in your area, ask your doctor’s office. If they aren’t sure, you can call Medicare at (800) 633-4227 and give the customer service representative the appropriate medical billing code, which you can obtain from your doctor’s office

Part B does not cover long-term care (i.e., custodial care — help with activities of daily living) regardless of where it is delivered. It also doesn’t cover vision, hearing, dental services, or general foot care unless they are medically necessary. For example, Part B will cover dental procedures you may need due to an injury, but not cavity repair or teeth cleaning. What about massage therapy? Acupuncture? Gym memberships? Nope! Nope! Nope! Also, with very few exceptions, Part B does not cover medical care received outside the United States.

What it costs

Part B isn’t free. You must pay premiums, deductibles, and co-pays.2

Part B Premiums

If you collect Social Security or Railroad Retirement benefits, the premium is deducted from your benefit payment. If you do not yet collect one of these benefits, Medicare bills you directly for the premium.

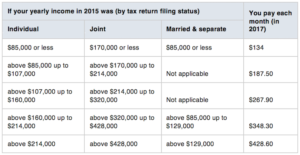

In 2017, the standard premium is $134 per month. However, people with higher incomes must pay a surcharge added to the standard premium, called the Income Related Monthly Adjustment Amount (IRMAA). Here is the current premium schedule from the Medicare.gov web site:3

Part B Deductible and Co-pays

In 2017, the Part B deductible is $183 per year. After you meet your deductible, you typically owe a 20% co-pay of the Medicare-approved amount for most Part B services. However, if your provider doesn’t accept the Medicare-approved amount as full payment, you might have to pay more than 20%. When selecting a medical provider, it is important to ask if they participate in Medicare, and if so, if they accept assignment – the technical term for agreeing to take the Medicare-approved amount for a service as full payment. If they don’t accept assignment, some of your co-pays will likely be higher, and you may even have to pay for some preventive services that are typically free with medical providers who accept assignment.

Traditional Medicare has no upper limit on out-of-pocket expenses. However, if you have Medigap insurance, it covers most of your Part B co-pays, as well as the deductible.

When to enroll (timing is critical)

Medicare Part B is impatient: unlike Part A, its more patient little sister, “B” doesn’t like to be kept waiting. So, it is important to enroll in Part B when you are first eligible (typically age 65, or younger with a qualifying disability) unless you have a legitimate reason to postpone it (more on that later). Otherwise, you will incur a late enrollment penalty consisting of higher premiums that will extend for your entire life. These penalties make sense if you think about it. As with any insurance, Medicare needs a large pool of subscribers – healthy as well as unhealthy – paying into the system in order to effectively manage the cost of medical claims. So, it “encourages” you to sign up as soon as you are eligible, or in some cases, as soon as you retire.

Assuming you live in the United States, you will automatically be enrolled in Part B when you turn 65 (or younger than 65 with a qualifying disability) if you are receiving Social Security or Railroad Retirement benefits. If you live outside the U.S. part of the year, you must actively enroll by contacting the Social Security Administration.4

If you are not yet receiving Social Security or Railroad Retirement benefits, Your Initial Enrollment Period (IEP) runs for seven months, including three months before your 65th birthday, the month you turn 65, and three months afterward. If you don’t enroll during this period, and you do not have a legitimate reason to postpone, you can still sign up during the General Enrollment Period (GEP) as a late enrollee (though higher lifetime premiums will apply) between January 1 and March 31 each year. Your coverage will start the following July 1. The longer you wait to enroll past your IEP, the higher your premiums will be. So, don’t be late!

There is a common exception to the age 65 enrollment rule. This exception has its own Special Enrollment Period (SEP): If you are covered under a group health plan based on current employment, and your employer has at least 20 people on staff, you may be able to postpone Part B enrollment, penalty-free, until after you leave your employer. This exception also applies if you are covered by your spouse’s employer health plan. Once your (or your spouse’s) employment ends, you will have eight months to sign up for Part B without incurring higher premiums. This exception generally does not apply to companies or organizations with fewer than 20 employees, so if you (or your spouse) work for such an employer, you will probably have to enroll in Part B during the seven-month window described above. It is always best to check with the employer whether you must consider Medicare Part B your primary coverage once you turn 65.

If you are at least 65 and retired, and you have retiree health benefits through your or your spouse’s former employer, the former employer may require that you enroll in Medicare Part B. Generally, Medicare is the primary coverage, and the retiree health plan is secondary. If they require Part B and you don’t enroll, you may find yourself uninsured for all practical purposes.

Finally, if you are on COBRA due to retirement or a lay-off, keep in mind that there is no Special Enrollment Period once COBRA ends — just the regular eight-month period once employment terminates. Moreover, COBRA benefits always pay secondary to Medicare. If you are at least 65 and have COBRA but not Medicare Part B, you may find yourself without primary health insurance at all!5 COBRA does have its advantages, especially as it relates to other parts of Medicare, so it may be beneficial to carry both COBRA and Part B for a time. But once you find yourself on COBRA for any reason, and you are at least 65, your eight-month Medicare Part B enrollment window will open. Again, don’t be late!

Overwhelming, you say?

Seven months for this, eight months for that. Let’s face it; Medicare, just like Social Security, is huge, complex, and confusing. There are thousands of rules, and almost as many exceptions. I’ve tried to summarize the most common elements of Part B in this article, but you may need more assistance than even your financial advisor can provide. Fortunately, there are state health insurance assistance programs, free of charge, in every state that can help you navigate Medicare. These programs go under different names and acronyms (e.g., SHIP, HICAP, SHINE) and exist in every state and territory of the United States. Just google “State Health Insurance Programs in [your state]” to find an office near you.

My next article will cover the ins and outs of Medigap, the supplemental plan to Medicare Parts A and B.

Footnotes:

1 Medicare for Dummies, Patricia Barry, AARP, p. 13

2Medicaid, the Federal health care program for the impoverished, will pay most of Part B premiums, deductibles, and co-pays for those who qualify.

3www.medicare.gov/your-medicare-costs/part-b-costs.html

4Enrollment in Medicare is always handled through the Social Security Administration, not through Medicare directly.

5Get What’s Yours for Medicare, by Philip Moeller, Simon & Schuster, p. 41.