Regardless of where you start, identifying your destination is the first step to getting there.

We work with you to build a financial plan that includes all of your major goals, financial and non-financial. We help you to specify the financial implications of your qualitative goals so that your living standard needn’t change to accommodate them.

What’s included in my plan?

- Detailed Action Plan

- Risk Management

- Cash Flow Plan

- Tax Minimization Strategy

- Integrated Investment Plan

We begin by asking where you are in life, and where you want to go.

- You may be starting out – planning for a house, maybe children and college – contemplating retirement (no work, some work, different work?), or retired.

- You may be a couple that wants a plan to buy a house, put children through college and retire comfortably. You may be single and plan to stay that way throughout your life.

- Your goals may be quantitative and financial – like a house down payment of a certain size, or qualitative and “soft,” such as a yearning for more family time.

Regardless of where you start, identifying your destination is the first step to getting there.

We work with you to build a financial plan that includes all of your major goals, financial and non-financial. We help you to specify the financial implications of your qualitative goals so that your living standard needn’t change to accommodate them.

Given the choice, most people prefer a stable living standard. They want to live well now and later. Planning to live better later isn’t attractive. Neither is a decline in lifestyle once the paychecks stop arriving. We work with you to identify a sustainable standard of living, one you can maintain throughout your life – before and after retirement.

Our Integrated Financial Plan does not address every financial issue. For example, the plan does not include advice about health insurance coverage or about property and casualty insurance. And of course, no plan can address every conceivable issue. We do our best to focus on the issues of greatest importance to you and those with the greatest likely impact on your financial goals.

Even the most careful plan is subject to risks.

We will identify the risks to your plan if you were to die prematurely. We will suggest capital replacement amounts that would counter these risks. These amounts typically decline as the risk to your family’s wealth diminishes. Many people choose to purchase life insurance to fund the uncertain capital requirements.

Similarly, we will identify the risks to your plan associated with disability. Income replacement is required to mitigate this risk. Many people choose to purchase disability insurance to fund this uncertain income requirement.

Finally, we’ll review the risks to your plan of the potential need for long-term care (LTC). We’ll help you assess the potential financial impact. Insurance is also available to mitigate this impact.

Sensible Financial is not an insurance advisor or insurance agent or broker. We can refer you to sources of life, disability and long-term care insurance products that we believe to be reliable.

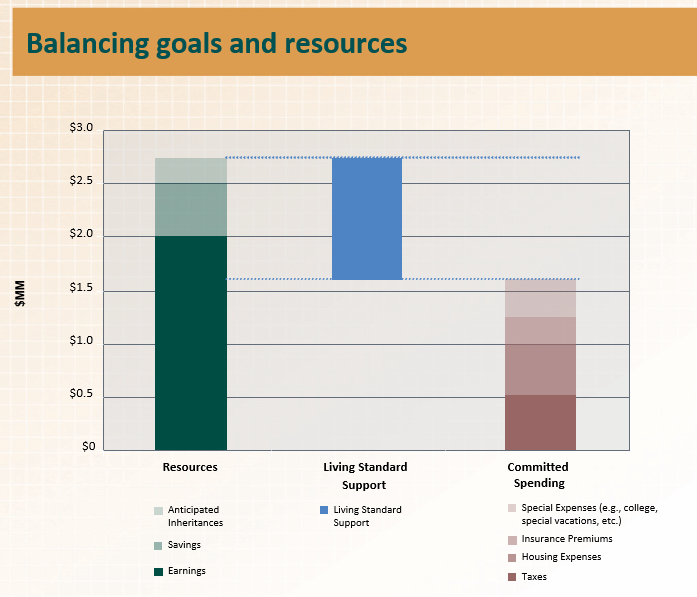

Conceptually, your Sensible Financial plan is very simple. We begin with your financial goals and resources. We add up all your resources and subtract the costs of your goals. The difference is available for everyday living. At your sustainable living standard, you spend that “everyday living budget” evenly over your lifetime.

By matching your financial resources and sustainable living standard with your financial goals, we develop a saving plan to build the assets you will accumulate over your lifetime. You will draw upon those assets to pay for later one time financial goals (such as college for your children or a down payment on a second home) and throughout your retirement.

Your saving plan will enable you to track your progress from year to year, adapting your savings and investing plans to:

- changes in your income

- changes in your financial goals

- more or less favorable investment returns

Your plan will encourage maximizing your financial resources. We will identify long-term tax minimization strategies such as tax-advantaged accounts and asset location (assigning assets to accounts to maximize after-tax return). We will consider the long-term tax implications of multiple jobs, retirement accounts, and investment strategies. We will help you to get the most out of your employee benefits package – tax-advantaged retirement accounts, employer contributions to your retirement accounts, and group life and disability insurance.

We can refer you to tax professionals to help with tax return preparation and specific complex tax issues.

You may plan to transfer assets to your children, your grandchildren, or other heirs. Your plan will identify potential Federal estate tax issues that might interfere with your plans. While we are not estate planning attorneys, we’ll also outline other considerations that may affect your family’s ability to carry out your wishes should you be unable to do so.

Your financial plan also includes an investment plan. We assess your current investment portfolio, including expected return and risk, and any unusual risks. These may include concentrated stock or bond holdings, relationships between your investments and your employment, and concentrated holdings of real estate. We provide a set of alternative asset allocations, and provide the risk and return implications for your financial goals. This helps you to select the allocation that you prefer. Finally, we recommend specific mutual funds to put that allocation into action.

How do you put my plan together?

At Sensible Financial® Planning, we take a holistic and highly personalized approach to financial planning. Financial planning necessarily involves working with numbers; a financial plan you can actually use requires numbers that are relevant to your life.

Analyze

Once we have all of the information we need, we organize it in our framework. We send you a set of assumptions summarizing the issues you want the plan to address, your financial information and the scenarios we will develop to illuminate your financial issues. Once you approve the assumptions, we develop a preliminary plan that estimates your sustainable living standard (the amount you can spend every year from now through the end of retirement) for each scenario. We determine how much you need to save each year, the risks to the plan, the likely growth of your assets, and the implications for your estate. We assess your current investment portfolio from the perspectives of likely return, risk and cost, and compare it to several alternatives on those dimensions. Then we meet with you to review the preliminary plan. We incorporate your views on the scenario and the asset allocation you prefer, and finalize the plan.

Propose

We begin with the investment options in any 401(k), 403(b) or similar account(s). We select the most cost effective, then move on to accounts where your choices are not restricted. Consistent with your target asset allocation at the end of the previous step, we recommend a diversified and efficient set of investments to help you accomplish your plan. If you wish, we can also recommend sources for any indicated insurance.

Act

If you wish, you may retain Sensible Financial to support you as you implement the plan, and to manage your assets on an ongoing basis. In addition, we can refer you to insurance resources to address insurance requirements identified in your plan. We also have a list of tax and estate planning professionals who can assist you in those important areas.

What tools do I use to develop my plan?

MaxiFi: State-of-the-Art Software for Financial Planning

MaxiFi® focuses on the fundamental goal of saving and insurance –avoiding major disruptions in your family’s living standard through the years. Using our core Economic Security Computation Engine, we calculate the saving you need to support a stable lifestyle throughout your life, and the life insurance required to preserve your household’s living standard in the face of risk.

What will this cost me?

We base our fee on the complexity of your financial situation. Factors in assessing complexity include:

- Client (and spouse or partner) age

- Family income

- Number of children

- Investable (liquid) assets and real assets (such as your home)

- Number of investment accounts

- Number of investment positions (securities held)

- Availability and accessibility of your financial information.

Our one-time fee for an integrated financial plan is usually between $5,000 and $10,000.

In cases of unusual complexity, (e.g. complexity factors include, but are not limited to, client age, net worth, real estate holdings, trusts, annuities, employment status, children, pensions, inheritances, and income tax situation), the fee can range as high as $15,000.

Contact Us

Planning your financial future?

Talk to one of our Financial Advisors today.